In This Article

- Understanding 30 Year Term Life Insurance

- Who is 30 Year Term Designed For?

- Benefits of 30 Year Term Life Insurance

- Drawbacks of 30 Year Term Life Insurance

- How Much Does 30 Year Term Cost?

- Alternatives to 30 Year Term Life Insurance

- Top Companies for 30 Year Term Life Insurance

- Examples of 30 Year Term Life Insurance

- Renewable Option

- Convertible Option

- Summary

Understanding 30 Year Term Life Insurance

30 year term life insurance is a type of term life insurance available in Canada. It is commonly purchased by Canadians between the ages of 20 and 55. It cannot be purchased after the age of 55.

Term life insurance is a type of life insurance which provides a fixed amount of coverage for a fixed amount of years. In this case, 30 year term life insurance is a life insurance product that has premiums (the cost of the policy) that are level for a period of 30 years. The death benefit (the coverage amount) is also level for thirty years. At the end of the 30 years, the insurance policy typically renews automatically at higher premiums (higher cost), again level for another 30 years. This process can continue until the expiration date of the policy which can be anywhere for 75-85 years of age (depending on the life insurance company).

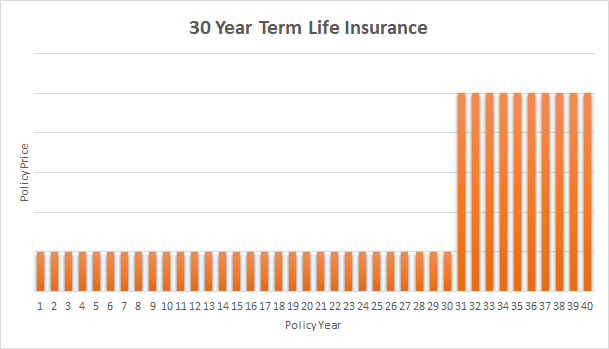

We have created a graph to help illustrate the increases in premium cost while you have your policy. If you keep your policy long term, every 30 years you will see a jump in price. It is very rare to see consumers pay the high renewal costs every 30 years as it is cheaper to re-apply for a new policy to get lower rates.

Who Is 30 Year Term Life Insurance Designed For?

30 year term life insurance is designed for Canadians who are looking for term life insurance for a longer period of time than the average consumer. It provides a high amount of life insurance coverage at a reasonable price.

It is most commonly purchased by families in their 20’s, 30’s and 40’s for life insurance protection for approximately 30 years to cover such things as an outstanding mortgage debt or until their children and/or spouse are self-sufficient financially. It is also a great product to use to provide life insurance coverage until retirement age.

As you increase the length of a term life insurance policy, the price of the policy premiums will also increase. 30 year term fits well for Canadians who need life insurance coverage for a long period of time. 10 year term is the shortest term length available to purchase currently. You used to be able to purchase a 5 year term (which would have lower premiums/cost compared to a 10 year term) but life insurance companies stopped offering them.

30 year term life insurance is also used by business owners who are looking to cover outstanding debt of their business or protect themselves in the event that a key employee(s) passes away.

Benefits of 30 Year Term Life Insurance

- 30 year term life insurance offers a great combination of reasonable premiums and amount of years for coverage.

- It provides the peace of mind knowing that your beneficiaries will receive a lump sum amount, tax free in the event of your death.

- The rates (cost of the policy) are guaranteed to be level (or fixed) for the length of the policy term which in this case is 30 years.

- 30 year term life insurance policies are very customizable which allows you to ensure that it suits the needs of you and your family.

- Most life insurance companies offer a renewable option within the policy.

- Most life insurance companies offer a conversion option within the policy.

- There are life insurance companies that sell term life insurance with no medical examination required.

Drawbacks of 30 Year Term Life Insurance

- The premiums (the cost) of a 30 year term life insurance policy are level for 30 years. Some Canadians require coverage for more than 30 years so you would have to revisit your options after 30 years. This could potentially result in being subjected to higher life insurance costs later in life. You should try to match the length of the term you are buying with the amount of years that you require life insurance coverage.

- At the end of the 30 years you have the ability to continue your policy but the increase in cost is quite high (typically around 4x your original premium- possibly higher).

How Much Does 30 Year Term Life Insurance Cost?

At the end of the day, the cost of a 30 year term life insurance policy is dependent on the health of the person applying. If you are in very good health you can qualify for discounted rates (preferred rates), but most Canadians end up qualifying for standard rates. There are also other factors which come into play when determining the price of 30 year term life insurance such as weight, smoking, lifestyle habits, medications, etc. We have put together some sample quotes from RBC Insurance below to give you an idea of the cost of 30 year term life insurance. All prices are monthly and based on health, non smokers.

| Male – Age 30 | Female – Age 30 | Male – Age 40 | Female – Age 40 | Male – Age 50 | Female – Age 50 | |

| $500K | $48.96 | $36.59 | $89.96 | $67.49 | $246.06 | $175.95 |

| $1M | $92.61 | $67.95 | $171.99 | $123.48 | $479.79 | $339.57 |

*Rates are monthly and based on standard health, non smoker from RBC Life Insurance Company.

**Rates were quoted June 2020 and are not guaranteed. Final rates are determined after an application has been submitted.

Alternatives to 30 Year Term Life Insurance

Even though 30 year term life insurance is a great fit for many Canadians, there are still other life insurance options to consider depending on your situation and needs. The cost for a 30 year term is going to be higher than shorter term lengths so it may be worthwhile to see what other options are available to help decide what life insurance product is right for you before you purchase.

Some Canadians may not require coverage for 30 years or they might need coverage for longer than 30 years (e.g. 35 year term life insurance or 40 year term life insurance). Your goal should be to try to match the length of the term with the amount of years that you require life insurance for.

If you feel that you require life insurance for your entire life to cover things such as funeral expenses or estate costs than you should consider permanent life insurance options such as whole life insurance, universal life insurance or term to 100 life insurance.

Top Companies for 30 Year Term Life Insurance

For the most part, 30 year term life insurance is very straight forward. It has level premiums and level coverage for 30 years. So why would we care which company we buy from? Should we just choose the lowest priced quote? Yes and no.

Life insurance companies are actually rated by a company called AM Best Company. This company reviews life insurance companies’ financial strength, ability to pay claims, history, credibility, etc. to help consumers understand which life insurance companies are the strongest.

We recommend dealing with term life insurance companies that have at least an ‘A’ rating and include the option to renew and convert your term life insurance policy. We also recommend purchasing term life insurance from a life insurance company that has quality permanent life insurance products in the event that you ever choose to convert your term life insurance policy to a permanent life insurance policy.

Not all life insurance companies in Canada offer 30 year term life insurance so your options are slightly reduced. Some life insurance companies that we recommend (but not limited to) purchasing term life insurance from are…

- Industrial Alliance

- RBC Insurance (Royal Bank of Canada)

- SSQ Insurance

- Wawanesa Insurance

- BMO Insurance (Bank of Montreal)

- Sun Life Insurance

- Canada Life Assurance Company

- Equitable Life Insurance

Examples of 30 Year Term Life Insurance

A 30 year term life insurance policy for $500,000 will have the same premium (cost of the policy) for the length of the term. In this case the length of the term is 30 years. The policy will also have the same coverage amount of $500,000 for the length of the term (30 years).

At the end of the 30 years the life insurance company will continue to offer you insurance at an increased price. This is called a renewal premium. The renewal premium is actually listed in your original policy contract so you can see what your renewal premiums every 30 years are if you look at your policy contract.

Renewable Option

Most term life insurance companies in Canada have a feature available called “renewable” or “renewability” where they allow you to continue your 30 year term policy after the initial 30 years.

At the end of the initial 30 years, the insurance policy typically renews automatically at higher premiums (higher cost), again level for another 30 years. This process can continue until the expiration date of the policy which is typically between ages 75 and 85 (depends on the company).

The reason the premiums are higher after the first 30 years is because the insurance company does not require any health questions or medical evidence (blood, urine, etc.). They are assuming that something has changed in your health which is why the policy premiums increase. If you are in good health and still need life insurance at the end of the 30 year term, you are usually better off applying for a new policy to get a lower premium and cancel your old policy after the new policy is in force.

The longer the length of the term, the higher the premiums will be. For example, a 35 year term life insurance policy costs more than a 30 year term life insurance policy. We recommend contacting us to determine what policy is right for you.

Convertible Option

Most term life insurance companies in Canada also have a feature called “convertible” or “conversion” which means that the policy owner is allowed to convert (switch) their term life insurance policy to a permanent life insurance policy (whole life insurance, universal life insurance, term to 100 life insurance) without having to complete a medical exam or health questionnaire. You are just required to do something called a policy change where you complete some paperwork, select a permanent life insurance policy and pay premiums based on your age and smoking status at the time of converting.

This is a feature that can become very valuable depending on the circumstances of the insured person. If you purchased a 30 year term life insurance policy and were diagnosed with a health condition that made it so you were unable to ever purchase life insurance again because no insurance company would insure you, having a policy that had a conversion option would be beneficial because it would still allow you to buy a permanent life insurance policy.

The conversion option would allow you the ability to switch your term life insurance policy to a permanent life insurance regardless of your health. The life insurance has to offer you permanent life insurance at regular, standard rates. This would ensure that you have the ability to have lifelong insurance protection regardless of your health.

We recommend that you speak with one of our licensed brokers regarding these options because they can be quite hard to understand without a clear explanation related to your situation.

Summary

30 year term life insurance fits the need for Canadians who need coverage for longer than the average consumer. You may be wanting coverage to last until your retirement, ensure that your mortgage term is covered or if you have started or planning to start a family. Please contact us if you have any additional questions or request a quote on our website.