A Complete Guide to Choosing the Right Life Insurance Company

Introduction

At its core insurance is a fairly straightforward idea. It is a promise made between a person and a company that if a particular event happens to the person that the company will provide them with a benefit. For life insurance in particular, that promise is that in the event that if you, as a policy owner, die, the insurance company pays your beneficiaries the death benefit amount stated on your policy. The key thing that you want to make sure of as a policy owner is that you are dealing with the right insurance carrier. No one wants to face the situation where their beneficiaries are left dealing with a difficult claims process because you chose the lowest premium and didn’t consider things like the company’s financial stability, customer service, policy options and many more factors we have listed below.

(If your employer offers group insurance, the insurer is usually selected by your employer, union, or association. However, if you don’t have access to a group life insurance plan, you may want to explore purchasing individual life insurance. In this guide, we’ll provide all the essential information to help you choose the right life insurance company for your specific needs.)

Overview

To help with things to consider when you are trying to choose the right life insurance company for your personal situation we’ve prepared a summary that will ask you to consider things like:

- Details about the life insurance companies themselves.

- Considerations of customer service and support.

- What type of insurance policies does the insurer offer?

- Who offers the best premium?

- What have other people you know experienced with different life insurance companies?

Where To Start When Choosing the Right Life Insurance Company?

How much the premium you pay when choosing a life insurance company is one factor in your decision but it shouldn’t be the only thing you consider. If you make your choice based solely on the premium for the coverage you want you miss out on many other things you should consider when you choose which company to place your life insurance with. Read on to find out why you should consider items beyond the premium.

16 Factors to Consider When Choosing the Right Life Insurance Company

- Financial Strength and Stability

- Product Offerings

- Premium Affordability

- Underwriting Process

- Claims Process and Payout History

- Customer Service and Support

- Cost of Insurance

- Conversion and Renewal Options

- Company Reviews

- Digital Tools and Resources

- Independent Broker

- Policy Transparency & Portability

- Industry Associations and Memberships

- Recommendations by Friends and Family

- Award Based Selection

- Company Provincial License

1. Financial Strength and Stability

Perhaps the most important part of choosing your life insurance company is making sure that there is a strong history of financial stability and strength behind them. Canada hasn’t experienced a life insurance company fail since 1994 when Confederation Life failed. Although there is protection for policy owners if their insurance company fails (Assuris, a non-profit organization provides this protection for policy owners), I am sure that you would prefer to avoid this situation altogether. One way to do this is to make sure that you research the company that will be holding your policy. Look into things like:

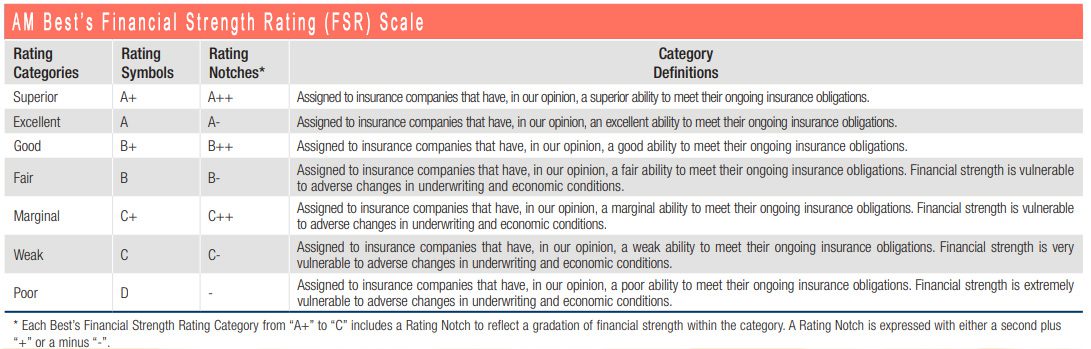

– Credit Ratings: Check ratings from agencies like A.M. Best, Moody’s, and Standard & Poor’s to assess the insurer’s financial health.

– Longevity in the Market: Established companies with a long track record are generally more stable.

– Market Size and Reputation

While all of these factors cannot guarantee the future of any company, it can definitely help assess the safety and security associated with the insurers that you choose to deal with.

Reference:

AM Best. (n.d.). About AM Best. Retrieved November 18, 2024, from https://web.ambest.com/about/

Table: AM Best Ratings Top Life Insurance Companies

| Life Insurance Company | A.M. Best Rating |

| Assumption Mutual Life Insurance Company | A- |

| Beneva Inc. | A |

| BMO Life Assurance Company | A |

| Canada Life Assurance Company, The | A+ |

| Co-operators Life Insurance Company | A |

| Desjardins Financial Security | N/A |

| Foresters Life Insurance Company | A |

| Industrial – Alliance Life Insurance | A+ |

| ivari | A_ |

| Manufacturers Life Insurance Company, The | A+ |

| RBC Life Insurance Company | A |

| Sun Life Assurance Company of Canada | A+ |

Table Life Insurance Company Based on Market Size and Reputation

When you are looking at insurers in Canada here is a table that summarizes the largest carriers showing how large their asset base is.

| Life Insurance Company | Total Assets | Source Link |

| Manulife Financial | $1.4 trillion | Manulife Annual Report 2023 |

| Sun Life Financiall | $1.4 trillion | Sun Life Annual Report 2023 |

| BMO Financial Group | $1.29 trillion | BMO Annual Report 2023 |

| Canada Life Assurance Company | $568 billion | Canada Life Annual Report 2023 |

| Desjardins Group | $422.9 billion | Desjardins Annual Report 2023 |

| iA Financial Group | $218.9 billion | iA Financial Annual Report 2023 |

| Co-operators Life Insurance | $19.1 billion | Co-operators Annual Report 2023 |

| Empire Life | $18.7 billion | Empire Life Annual Report 2023 |

| Equitable Life of Canada | $8.1 billion | Equitable Life Annual Report 2023 |

| RBC Insurance | $5.04 billion | RBC Annual Report 2023 |

2. Product Offerings

Table: Product Offerings from Top Canadian Life Insurance Companies

| Life Insurance Company | Term | Whole | Universal | Disability | Critical Illness |

|---|---|---|---|---|---|

| Assumption Mutual Life Insurance Company | ✔ | ✔ | ✔ | ✔ | |

| Beneva Inc. | ✔ | ✔ | ✔ | ✔ | ✔ |

| BMO Life Assurance Company | ✔ | ✔ | ✔ | ✔ | |

| Canada Life Assurance Company | ✔ | ✔ | ✔ | ✔ | ✔ |

| Co-operators Life Insurance Company | ✔ | ✔ | ✔ | ✔ | |

| Desjardins Financial Security | ✔ | ✔ | ✔ | ✔ | ✔ |

| Foresters Life Insurance Company | ✔ | ✔ | ✔ | ||

| Industrial Alliance Life Insurance | ✔ | ✔ | ✔ | ✔ | ✔ |

| ivari | ✔ | ✔ | ✔ | ||

| Manulife (Manufacturers Life Insurance) | ✔ | ✔ | ✔ | ✔ | ✔ |

| Primerica Life Insurance Company | ✔ | ✔ | ✔ | ||

| RBC Life Insurance Company | ✔ | ✔ | ✔ | ✔ | ✔ |

| Sun Life Assurance Company of Canada | ✔ | ✔ | ✔ | ✔ | ✔ |

3. Premium Affordability

Premium affordability is one of the key concerns when you are dealing with the decision to purchase life insurance. You need to make sure that the premiums that you are required to pay fit within your budget so that you can maintain the coverage that you need. There is no point in choosing a policy with a premium amount that isn’t sustainable for you because that leads to the likelihood that the policy won’t be in force when you need it most. Remember to focus on a few key points when it comes to comparing premiums:

– Premium Costs: As long as you are looking at similar coverages (i.e. term insurance versus term insurance) comparing premium costs is an important part of choosing the right life insurance company for you. Contacting a broker like lifeinsurancecanada.com, who can run quotes with multiple companies and show you the premiums for each of them will allow you to see who offers the best coverage versus premium in the life insurance market.

– Flexible Payment Schedules: How often will the insurer allow you to make payments and does it fit into your personal cash flow should also factor into your decision. Some insurers offer flexible payment options, such as annual, semi-annual, or monthly payments. Just make sure that you check the amounts as well. Oftentimes you can save money by paying annually versus monthly.

– Premium Stability Over Time: You need to understand not only what you will pay for your coverage today but also what you will pay for it going forwards. A term insurance policy will lay out for you what the premiums are at every renewal point from policy issue until the expiry of the contract. You should also watch for the fact that some permanent policies can also have premiums that vary as well. Pay particular attention to Universal Life policies and make sure you know if the cost of insurance in the policy is level or if it increases annually.

Table: Comparing Premium Affordability Among Canadian Life Insurance Companies

Monthly Premiums are approximate figures for a 35-year-old male, non-smoker seeking $500,000 in term life coverage.

| Life Insurance Company | Term-10 Monthly Premium | Term-20 Monthly Premium |

| Assumption Mutual Life Insurance Company | $23.85 | $32.40 |

| Beneva Inc | $23.85 | $31.50 |

| BMO Life Assurance Company | $26.55 | $32.40 |

| Canada Life Assurance Company | $23.70 | $33.27 |

| Co-operators Life Insurance Company | $22.50 | $31.05 |

| Desjardins Financial Security | $23.40 | $31.50 |

| Empire Life Insurance | $22.95 | $31.05 |

| Equitable Life Insurance Company of Canada | $22.97 | $31.64 |

| Foresters Life Insurance Company | $22.50 | $31.50 |

| Industrial Alliance Life Insurance | $23.85 | $31.95 |

| ivari | $20.25 | $34.20 |

| Manulife (Manufacturers Life Insurance) | $23.73 | $32.52 |

| Primerica Life Insurance Company | $30.83 | $40.83 |

| RBC Life Insurance Company | $22.05 | $30.42 |

| Sun Life Assurance Company of Canada | $26.10 | $32.85 |

| Wawanesa Life Insurance Company | $23.85 | $32.85 |

4. Underwriting Process

Understanding the underwriting process that insurers follow will help you choose the best company for your personal situation as well. For example, if you need a company that looks favourably on your passionate hobby of spelunking it is a good idea to find out which insurers would disqualify you immediately for following your heart. It’s not just dangerous hobbies that you should be aware of though. Remember to consider how an insurer looks at the following:

- Medical Requirements: Does the insurer require a medical exam and does this matter to you? Different companies have simplified/no-medical exam options, if you have a pre-existing medical condition it may be worthwhile making sure that these types of policies are available from the insurer that you choose.

- Underwriting Policies: All insurers have different guidelines that they follow internally that can help you get a policy issued. Knowing which insurer has more lenient underwriting for specific health conditions or age groups can be beneficial for helping you choose who to apply for coverage with.

5. Claims Process and Payout History

The main reason that anyone takes out life insurance is so that in the event that they pass away, their beneficiaries receive the proceeds of the policy quickly and the process for getting those funds is as seamless as possible. At a time when you, as the beneficiary of the policy, are dealing with the loss of someone close to you, you really don’t want to also be dealing with a convoluted claims process that makes receiving the funds from the policy difficult. A couple of things to consider when you are choosing which life insurance company to deal with include:

– Claim Paid Ratio: This ratio provides you with information about an insurance company’s claim approval rates, helping you gauge how reliable they are in honoring claims.

– Claims Process: Knowing how quickly and efficiently the insurer processes claims and understanding their reputation for customer support during claims will also remove stress in the event that you are making a claim.

In 2023, Canada’s life and health insurers have paid out $128 billion in total claims.

Source: CLHIA, Canadian Life & Health Insurance Facts, 2024 Edition , p. 3, (report includes 2023 results). Retrieved from CLHIA Factbook

6. Customer Service and Support

When you are choosing the right life insurance company you should also look at how they support policy owners throughout the lifespan of a life insurance policy. This means that you want to understand the customer service they provide at various points in time from the initial sale of the policy right up until claims are made. Some of the key items for considering when you are researching customer support are:

– Ease of Contact: How easy is it to get in touch with someone regarding the policy? A suggestion is to look for companies with accessible customer service options, including phone, online chat, or in-person support.

– Customer Feedback: This can be very helpful. Read customer reviews that talk about their experience with the insurance company personally. You can also check the ratings of the insurers on platforms like the Better Business Bureau, and consult Google or other review sites.

– Ongoing Support: This is one of the most important things to consider. If you need help doing something like changing a beneficiary, updating your address or changing the bank account the premium is paid from, will you receive the support you need to do this easily and quickly? Follow up to make sure that the insurer you choose has a good track record of providing good support throughout the policy term, including guidance for beneficiaries during claims.

Table: Customer Service and Support Links for Leading Canadian Life Insurance Companies

7. Cost of Insurance

When you are given the premium for the life insurance policy it is actually made up of a few different things. There is the actual cost of the insurance, which is associated with the risk you pose to the insurer, but there may be other fees included. Knowing how much an insurer charges for these items can also help you in choosing the right insurance company.

Administration fees: These fees help cover the costs associated with maintaining your life insurance policy. One way to minimize administration fees is to pay the premium annually. This lowers the administration on the policy by only needing one payment processed a year versus twelve processing dates if you pay monthly.

Policy fees: This is a fee associated with a policy that funds things like underwriting, policy creation and ongoing administration.Surrender charges (for early cancellation): This applies to policies with cash values associated with them, and is a fee that may be applied if you choose to surrender the policy during a predetermined time period from the beginning of the policy. The length of this time period varies so understanding how long it is applicable for is a good thing to know when you apply for coverage.

Working with an experienced life insurance agent, like the team at LifeInsuranceCanada.com, will help you in understanding all of the fees and charges applicable to your life insurance plan. This can help you avoid concern over paying too much due to some type of ‘hidden’ fee on the policy.

8. Conversion and Renewal Options

Many insurers will provide you with the opportunity to convert or guarantee renewals for term insurance policies. When you are choosing a life insurance company you may want to think about how these options can apply to the policy.

Conversion Privileges: Many insurers will provide term insurance policy owners the option to convert their term insurance to permanent insurance without requiring any further underwriting. If this is an option that may be of interest to you one of the things to consider is what type of permanent options does the insurer offer? Making sure that an insurer has a complete shelf of whole life and universal life insurance policies makes your conversion option worth more to you.

Renewability: What happens at the end of the term for your policy is important. For example, is it guaranteed to renew without any underwriting being required? Understanding if your policy allows you to renew at the end of the term, and understanding how it renews are essential.

9. Company Reviews

When you are choosing what the right life insurance company is for you, there are resources that can help you in your quest. Although care is required with making sure that you understand the source of the information, checking online reviews is one powerful tool at your fingertips. I recommend taking this information with a grain of salt though because, more often than not, people who have had great experiences don’t take the time to share them online while someone who has had a negative experience will want to tell the world about it.

You can also consult places like the Canadian Life & Health Insurance Association to find out about how many complaints are put through to ombudsmen each year and find out about how quickly insurers typically resolve customer complaints.

Where to Find Reviews for Life Insurance Companies

- Google Reviews: Many life insurance companies have profiles on Google where customers leave feedback. Reading these reviews can provide firsthand accounts of customer experiences, highlighting both positive aspects and potential concerns.

- Better Business Bureau (BBB) Canada: The BBB evaluates businesses based on customer complaints and resolutions. Checking a company’s BBB rating and reviews can help you understand their commitment to customer service and ethical practices.

- Trustpilot: An international review site where customers share their experiences with businesses, including insurance companies. It provides a broader perspective on customer satisfaction.

- Facebook: Many insurance companies have Facebook pages with reviews and ratings from customers.

- Yellow Pages Canada: The Canadian Yellow Pages website often includes customer reviews for businesses, including insurance companies.

- Glassdoor and Indeed: While primarily for employee reviews, Glassdoor and Indeed can provide insights into the company’s internal culture, values, and customer service ethos, which indirectly reflects how they may treat policyholders.

- Reddit: Various subreddits, such as r/PersonalFinanceCanada, feature real-life experiences and discussions about life insurance companies in Canada. These community discussions can provide honest and sometimes in-depth perspectives.

- LifeInsuranceCanada.com: Check out our reviews for insights on Canadian life insurance companies.

10. Digital Tools and Resources

For some people they may not be able to believe this, but it wasn’t that long ago that, when the premium was due for your life insurance policy a representative from the insurance company came to your home or business and collected the premium from you in cash. They issued you a receipt right at your door and would submit these payments to the insurance company. This seems like a pretty labour intensive process given today’s digital world, so you probably are more interested in the digital tools and resources that are available to you than who it is that will come to your door every month to collect the premium for your policy. Make sure you consider if the insurer you choose provides:

– Online Account Access: Does the company provide smartphone app’s? What about an online portal where you can manage your policy? All of these services can make your life substantially easier when it comes to looking after your life insurance policy.

– Educational Resources: Check out the insurers website as well and see if they offer clients access to any additional educational resources like calculators, guides, and educational articles. This shows a commitment to helping clients make informed choices.

For example: Manulife plan members now expect fully digital access to connect with and use their plan

- Easy-to-use, self-serve digital tools to manage their plan

- 24/7 personalized and secure mobile access, allowing members to track and manage their savings anytime, anywhere

- Remote professional guidance to help members manage their finances during these unpredictable times

Source: Manulife, “Three ways Manulife’s digital tools are helping our members reduce stress”

11. Independent Broker

This is one of the ways that someone can help you choose the right life insurance company for you. An independent life insurance broker is a great resource for you to take advantage of. An independent broker is someone who will be able to shop your particular case to a variety of insurance companies and provide you with many options, as well as advice on which insurer makes the most sense in your particular situation. Make sure that when you look for a broker you remember, independent brokers provide you with unbiased advice. They are not connected to any single insurance company and as a result they are able to compare products from multiple insurers for you.

Why Choosing The Right Life Insurance Broker Is The Key to Choosing The Right Life Insurance Company

- Provides unbiased recommendations

- Compare Multiple Life Insurance Companies

- Offers access to the best life insurance rates and policies

- Makes understanding insurance policies easier

- Saves time by doing the research for you

- Assistants with the claims process

How Do I Find a Life Insurance Broker?

- Verify Credentials: Ensure the broker is licensed in your province. Check with your provincial regulatory bodies, such as the Financial Services Regulatory Authority of Ontario (FSRA).

- Check Professional Associations: Visit the websites of organizations like the Canadian Life and Health Insurance Association (CLHIA)

- Contact Insurance Companies Directly: Many companies can connect you with an independent broker who sells their policies.

Why Choose LifeInsuranceCanada.com as Your Life Insurance Broker

When you are looking for a trusted life insurance broker you should choose lifeinsurancecanada.com as your broker for a variety of reasons. An experienced group of advisors like the team at LifeInsuranceCanada.com provides the backbone of a trusted and reliable life insurance broker for several key reasons:

- Licensed Across All Provinces:

- 5-Star Google Reviews:

- Access to Top Insurance Companies:

- Unbiased Recommendations: .

- Expert Guidance:

- Seamless Process:

Expert’s Viewpoint“We truly believe that it is in the policy owners best interest to deal with a life insurance broker that completes a comprehensive market survey and provides you with guidance about what policy fits your unique circumstance”

Simon Huften – President Life Insurance Canada

12. Policy Transparency & Portability

One key thing for you as a policy owner when you are trying to figure out which is the right life insurance company for you to deal with is to consider the policy itself. For example, how transparent is the insurer with the terms of the policy? You want to make sure that your policy contains:

- Clear Terms and Conditions – You want the policy document to provide clear and concise wording that will highlight any exclusions, limitations, and terms without hidden clauses.

- Easy-to-Understand Policy Language – Choose a company that makes the legal terms of the policy accessible and transparent by using easy to understand language. They should minimize confusing legal or technical jargon.

- CLHIA Membership – Look for companies that are members of the Canadian Life and Health Insurance Association (CLHIA). Membership in an organization such as the CLHIA reflects the insurance company’s commitment to ethical practices and transparency in dealing with clients.

You also should consider the portability of policies. This would include a couple of things. The first would be the ease with which you can transfer a policy. If the process to transfer a policy is onerous it may create issues for you in the future. The second would be, is there consistent service available across many regions for the policy. This becomes important if you were to move from one province to another. Making sure in advance that you will still be able to receive support for your policies regardless of where you live is very important.

13. Industry Associations and Memberships

When choosing which is the right life insurance company for you it is important that you understand where the companies stand in the industry. In general there are a few key industry associations and memberships that you want to make sure that your insurer has. The first is membership in the Canadian Life and Health Insurance Association (CLHIA) and the second is that your policies are covered by Assuris. Assuris is an independent, non-profit organization that protects policy owners of Canadian life insurance policies in the event of the failure of an insurance company.

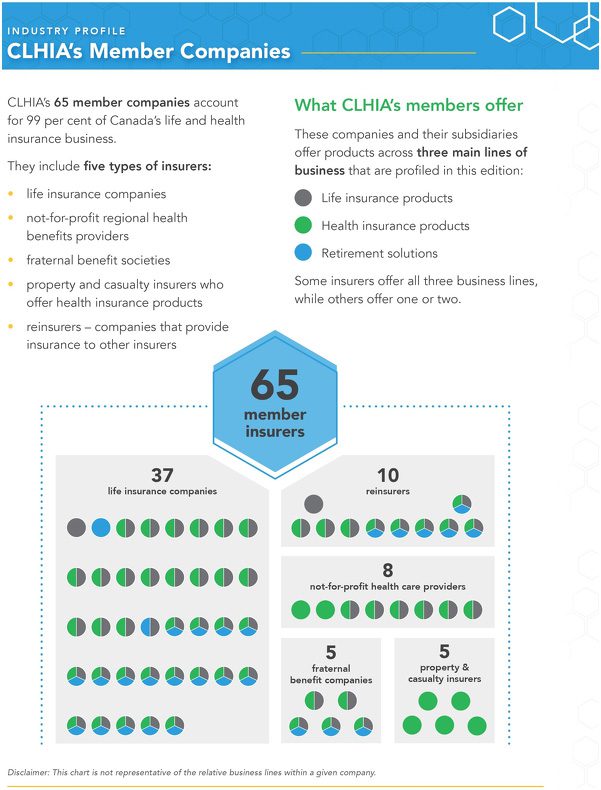

How Many CLHIA’s Member Companies in Canada?

According to the Canadian Life & health insurance Association’s (CLHIA) 2024 report.

There are 65 member insurers (37 life insurance companies) 10 reinsurers, 8 non-for-profit health care providers, 5 fraternal benefit companies, 5 property & casualty insurers

Why Assuris Matters When Choosing a Life Insurance Company

When you’re choosing a life insurance company in Canada it’s important to check if the company is a member of Assuris.

Assuris is an independent, not for profit, industry-funded compensation organization founded in 1990. Every life and health insurance company authorized to sell insurance in Canada is required, by the federal, provincial, and territorial regulators, to become a member of Assuris under the Insurance Companies Act of Canada

How to Check for Assuris Membership

Visit the Assuris website, where you can search for the List of Member Companies.

Member companies of Assuris are:

| A Acadia Life Aetna Life Insurance Company Allianz Life Insurance Company of North America Allstate Life Insurance Company of Canada American Bankers Life Assurance Company of Florida American Health and Life Insurance Company American Income Life Insurance Company Assumption Mutual Life Insurance Company AWP Health & Life SA B Beneva Blue Cross Life Insurance Company of Canada BMO Life Assurance Company BMO Life Insurance Company Brookfield Annuity Company C The Canada Life Assurance Company The Canada Life Insurance Company of Canada Canadian Premier Life Insurance Company Canassurance Hospital Service Association Canassurance Insurance Company Chubb Life Insurance Company of Canada CIBC Life Insurance Company Limited CIGNA Life Insurance Company of Canada Combined Insurance Company of America CompCorp Life Insurance Company Connecticut General Life Insurance Company Co-operators Life Insurance Company D Desjardins Financial Security Life Assurance Company | E The Empire Life Insurance Company The Equitable Life Insurance Company of Canada F First Canadian Insurance Corporation Foresters Life Insurance Company G Green Shield Canada Green Shield Canada Insurance H Humania Assurance Inc. I Industrial Alliance Insurance and Financial Services Inc. ivari The Independent Order of Foresters J Jackson National Life Insurance Company L Life Insurance Company of North America LS-Travel, Insurance Company M The Manufacturers Life Insurance Company Manulife Assurance Company of Canada MD Life Insurance Company Medavie Inc. Metropolitan Life Insurance Company | N National Bank Life Insurance Company New York Life Insurance Company O L’Ordre indépendant des forestiers P Pavonia Life Insurance Company of Michigan PBC Health Benefits Society o/a Pacific Blue Cross Primerica Life Insurance Company of Canada R RBC Life Insurance Company Reliable Life Insurance Company S Scotia Life Insurance Company Sun Life Assurance Company of Canada Sun Life Insurance (Canada) Limited T TD Life Insurance Company Trans Global Life Insurance Company TruStage Life of Canada U The Union Life, Mutual Assurance Company (UV Insurance) V Viaction Insurance inc. W The Wawanesa Life Insurance Company |

14. Choosing a Life Insurance Company Recommended by Friends and Family

When it comes to many decisions in your life the experiences that your friends and family have had can play a role in making your life easier. If you have similar tastes, the recommendation of a close friend for a restaurant they liked can be the reason that you may go out of your way to try it. The same can also be true when you are trying to choose the right life insurance company. A personal recommendation from your friends and family can be a great source of information for you because you get to find out about their experience with a company. You can typically rely on these recommendations because they provide you with:

- Trusted Experiences

- Honest Answers

- Recommendations for Reliable Agents or Brokers

- Understanding Real Cost

- Gaining Insight on Customer Service Quality

What to Ask Friends and Family About Their Life Insurance Company

As some conversation starters here is a list of questions that you could ask friends and family about who they have life insurance with and why they chose that company when they were seeking out life insurance.

10 Common Questions to Ask Your Friends and Family:

- Why did you choose your life insurance company?

- What made this company stand out compared to others?

- Are you happy with your life insurance policy?

- Is the company easy to work with if you have questions or need help?

- What has your experience been with their customer service?

- Do you feel like you’re paying a fair price for your policy?

- Did the company explain things clearly, including any extra fees?

- If you’ve made a claim, was the process simple and fair?

- Would you recommend this company to me?

- Did you check if the company is financially strong with good ratings, and do you feel confident they’ll be around long-term?

Personal recommendations from friends and family are a great way for you to find out the good and the bad that people you like, know and trust have had with insurance companies. This can provide you with a great basis upon which to decide what the right life insurance company for you is.

15. Using Awards to Choose The Best Life Insurance Company

Companies that receive industry awards are being recognized as leaders in the field that they work in. One of the ways that you can identify a life insurance company that is committed to excellence is to follow which companies have received awards recently from industry experts.

World Finance

World Finance is a print and online magazine providing comprehensive coverage and analysis of the financial industry, international business and the global economy. Selection process involves both public voting and evaluation by a panel of experts.

Table: World Finance Insurance Awards for the Best Life Insurance Company in Canada

| Year Awarded | Life Insurance Company |

|---|---|

| 2024 | Canada Life |

| 2023 | Canada Life |

| 2022 | Canada Life |

| 2021 | Sun Life Financial |

| 2020 | Sun Life Financial |

| 2019 | Canada Life |

| 2018 | BMO Insurance |

| 2017 | BMO Insurance |

| 2016 | Manulife |

| 2015 | Manulife |

| 2014 | Empire Life |

| 2013 | Empire Life |

16. Is the Life Insurance Company Licensed in Your Province?

Canada is unique in many ways. This includes the fact that there are different sets of laws that apply to the same industries across our country, depending on which province or territory you are in. Making sure that you are dealing with an insurance company or broker that is licensed in all the provinces in Canada will make your life much easier because you will be assured that you can always contact your broker regardless of where you live in the country. As a quick guide on this here is how you can determine where the broker or company you are dealing with is licensed.

How to Check Licensing

- Check the Regulator’s Website

Visit your province’s insurance regulator website to search for licensed companies. - Ask the Insurance Company

Ask the company directly about their licensing status. - Search Online

Look for confirmation on the company’s website, where they should list their authorized provinces.

Conclusion

Choosing the right life insurance company should be based on many things, not simply who provides the best premium. Taking the time prior to buying your policy to make sure that you are choosing the right insurer for your personal situation will eliminate headaches in the long run for you. Like so many things in life, an ounce of prevention is worth a pound of cure, so take the time to weigh all the factors discussed here before you decide what life insurance company is right for you. And if it all seems overwhelming, make use of a team of experts, like the ones at LifeInsuranceCanada.com to help guide you through to the right spot for you.

Simon Huften – President Life Insurance Canada

Simon Huften – President Life Insurance Canada