If you’re reading this, it means you’re thinking about making your Will.

First off, congratulations—you’re already winning! In Canada, almost two-thirds of adults either don’t have a Will or have one that isn’t up-to-date or valid.

So if you actually go through the process and create a Will, you’ll be in the minority of Canadians who are truly prepared for the future.

In This Article

- Who Is Eligible To Make a Will In Canada?

- Four Ways To Make a Will In Canada

- What To Include In Your Will

- What You Might Not Include In Your Will

- Making Your Will Official

- Summary

Who Is Eligible To Make A Will In Canada?

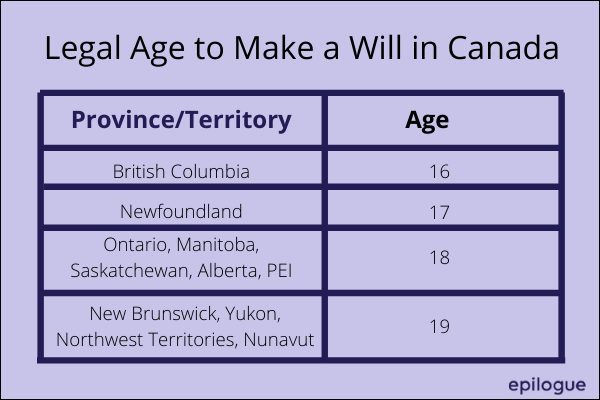

Anyone who is the legal age to make a Will in their province and “of sound mind” can make a Will.

From a legal standpoint, being “of sound mind” refers to being mentally healthy and fully competent to make rational decisions for yourself.

The legal age to make a Will differs across provinces. Fun fact: The legal age to make a will isn’t necessarily the same as the age of majority (18 or 19)— it can be as young as 16 years old or as old as 19. Of course, someone may not think it’s necessary to complete a Will at the ripe age of 16; however, it’s a good practice to start thinking about these things early on as your Will can (and should) be updated regularly as life evolves and your wishes change.

Free Life Insurance Quote

Four Ways To Make a Will In Canada

When it comes to creating your Will, you have some options. Contrary to popular belief, you don’t need to visit a lawyer’s office and pay hefty fees to complete your Will. The best option for you depends on your situation and particular needs.

Here are your four main options when it comes to making your Will.

Option 1: Make a Will with a lawyer

Going to a lawyer is probably your first instinct when you think about making a Will. While more complex situations require a visit to a lawyer’s office, the truth is that most Canadians only need a basic Will.

Visiting a lawyer can run you anywhere from $300 to over $1000, depending on your situation. The good news is there are much more affordable alternatives for people who don’t have complicated situations.

Who should make their will with a lawyer?

So, what do we mean when we say ‘complex situation’?

The following are examples of situations where it’s best to see a lawyer to make a Will and get legal advice:

- You have a child with a disability who receives government benefits.

- You have assets outside of Canada.

- You want to exclude a spouse or child from the Will.

- You have children from multiple marriages.

- You want to do sophisticated tax planning.

Option 2: Make a Will online

Did you know: You can do your estate planning without ever leaving your home (or even putting on pants)?!

Visiting a lawyer’s office might not be physically or financially possible and, if you only need a basic will, it might not be necessary either.

The good news is seeing a lawyer isn’t your only option to get high-quality estate planning documents. There are now online will solutions that offer a much more accessible and affordable way to make your Will from the comfort of your own home.

One significant advantage of using an online estate planning platform is most online solutions also allow you to log in and update your Will free of charge, as many times as you need. This is especially useful for younger people and growing families.

You can purchase an online Will for a fraction of the cost of seeing a lawyer (Under $150).

Free Life Insurance Quote

Who should use an online will platform?

As mentioned, online Wills are an ideal solution for individuals who only need a basic Will. The best time to make a Will is now; however, most people choose to make (or update) their Will when they go through a major life event or milestone, like:

- Buying a new home

- Having a baby

- Getting married

- Getting separated

- Getting divorced

- Getting a new pet

- Inheriting a large sum of money or expensive asset(s)

Option 3: Make a holographic Will

A holographic Will is a Will that is written entirely by hand. We’re talking pen to paper.

Holographic Wills are perfectly legal as long as every word is in your handwriting; however, this isn’t a very popular option because of how easy it is to make a mistake.

Including too little (or too much) information can make your Will vulnerable to being contested after you pass away. When a Will is contested, it goes to court, which can be a time-consuming and expensive process—not to mention the tension it creates among family members. The worst part: When a Will is contested, you aren’t around to explain yourself. So, it’s better to make sure you create an iron-clad will while you’re still alive.

Unlike most Wills, Holographic Wills do not need to be witnessed to be valid. All other Wills must be witnessed and signed by two people who have no stake or claim to your estate.

Who should make a holographic Will?

We don’t recommend making a holographic Will in general unless you are an estate lawyer and have a deep understanding of what a Will should and should not include. Even then, the likelihood of taking the time to write your Will by hand is next to none. That said, it might be good to know this option exists if you are in a pinch or an emergency situation.

For example, in 1948, one farmer got trapped under his tractor and feared he wouldn’t survive, so he etched his final wishes onto the fender. Sadly, the farmer did not survive the accident, and his holographic Will held up in court! This is obviously an extreme example… but you get the point.

But it’s best not to wait until you’re pinned under heavy machinery or run into another unforeseen circumstance to make your Will. We recommend planning ahead and either seeing a lawyer or using a reputable online platform to complete your estate planning. That way, you know you have your bases covered, and you and your family are protected, no matter what happens.

Option 4: Use a DIY Will kit

You can buy Will kits (also called blank form Will kits) at your local post office, Staples, or Walmart. These kits often contain a very oversimplified version of a Will. They can be either paper or online format, where you have to download software onto your computer.

While they are 100% legal (as long as they are witnessed and signed correctly,) they aren’t always the most comprehensive, leaving much to be desired from a planning perspective.

Some other drawbacks to DIY Will kits include:

- The legalese and instructions can be confusing, and you won’t have access to customer support.

- You can’t make updates without buying multiple kits.

On the plus side, DIY Will kits are the most cost-effective, selling for as little as $20.

Who should use a DIY Will kit?

If you need a very basic Will, but the cost is a limiting factor, a DIY Will kit could be a good option. Keep in mind that you need to factor in the price of multiple kits if you have to make many updates (which you inevitably will have to do.)

Free Life Insurance Quote

What To Include In Your Will

Some people are under the false impression that a Will must list out every single item you own and account for every dollar down to the cent—this is definitely not the case.

To get started, you only need a general sense of your assets and debts.

When preparing to write a Will, here are some of the main things you should be thinking about:

- Beneficiaries. These are the people to whom you’ll distribute your money and things.

- Guardian for your minor children. You’ll have to appoint someone to take over legal guardianship of your kids should you and your spouse pass away while your children are still minors.

- Charities. You can leave gifts to charities or causes you care about most.

- Appointing an executor. You’ll need to choose someone you trust to wrap up your affairs and make sure all the wishes in your Will get fulfilled after you die.

What You Might Not Include In Your Will

There are some things that are generally not included in your Will. Here are some examples:

- Life insurance policies (if you completed a beneficiary designation with the institution.)

- Jointly owned assets like real estate, businesses, or bank accounts.

- Funeral and burial wishes (it is best to do this in a separate document.)

- Gifts and money for pets (pets are considered assets in your Will, so you technically can’t leave them anything. You can leave your pet to someone (their “guardian”) and give any gifts and money to that person.)

Making Your Will Official

Making a Will is one thing but ensuring it’s legally valid is another. Except for holographic Wills, all other Wills must be signed and witnessed to hold up in court as a legal document.

First off, your Will must be in paper form. That means if you’ve made your Will online, you have to print one copy (you can only have one legal copy of your Will.)

The next essential requirement is that you sign your Will in the presence of two witnesses. They also must sign and date the Will in your presence and the presence of each other. It’s also best practice for everyone to initial each page.

The law sets out that some people shouldn’t be your witnesses. Generally, anyone that has any particular interest in your Will should not be a witness. For example, your spouse or the spouse of any of your beneficiaries.

Once you’ve signed and dated your Will per the rules of your province, you have a valid Will and the peace of mind knowing you’ve taken this critical step to protecting your loved ones now and well into the future.

Summary

Creating a Will is something that many Canadians put off or forget about. A Will ensures that your wishes are kept in place when you are no longer here. Life Insurance Canada.com has partnered with Epilogue to offer Wills for our clients at discounted rates. Contact us for more information or head over to Axess Law to create a Will online today.