Get Approved and Avoid Delays by Completing Your Life Insurance Application the Right Way

Introduction

Life insurance is an essential part of your financial security plan. Its ability to protect your loved ones or business partners from potentially severe financial consequences makes life insurance something that all people should consider owning. One thing to know about a life insurance policy is that it is a one-way contract. What this means is that once the policy is issued, the policyholder is the only party that can reopen the terms of the contract, provided they stay within the conditions laid out in the policy. The insurance company has the application and underwriting process during which they can analyze the applicant for suitability; once this is done, as long as the premiums are paid and the policy terms are met, they must honour the contract. This means that any application for life insurance that you make needs to be done completely and correctly. Not only will this expedite the approval process for the policy being issued, but it will also ensure that the policy is enforceable in the future. Working with a life insurance broker can help you ensure an accurate, complete life insurance application arrives for the company underwriters to review. This will expedite any decisions that the underwriters will make and could even potentially lower the premiums you pay. This article will help you complete a life insurance application accurately by avoiding common mistakes and increasing your chances of approval by underwriters.

Overview

In this article, we are going to cover some key points. They will include:

- What a life insurance application looks like

- How to fill out a life insurance application

- What the application process looks like

- Steps in the application process

- Some common mistakes that you should try and avoid on your life insurance application

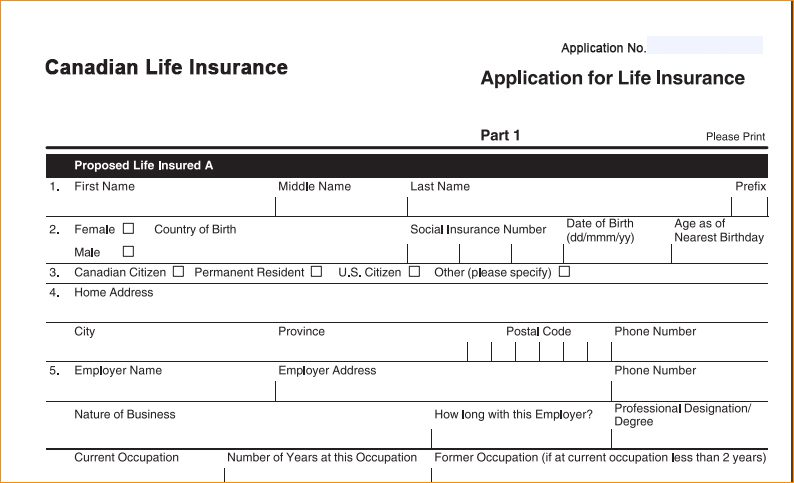

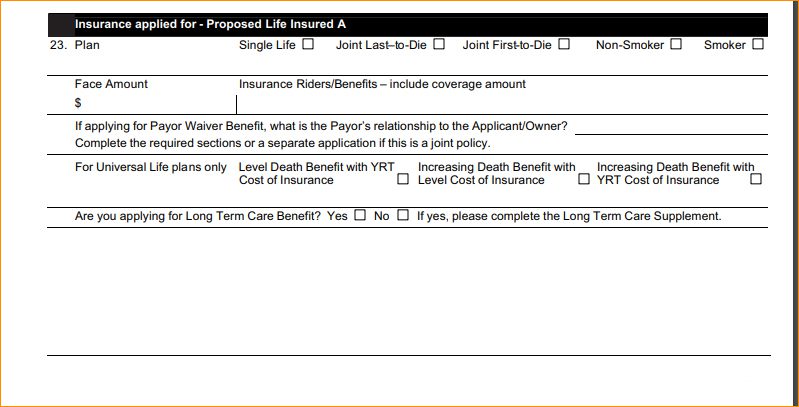

Example Life Insurance Application Form (download pdf)

One of the easiest ways to review what you will need when you are completing a life insurance application is to actually look at what a real-life insurance application looks like. This gives you the chance to look at the type of information that the insurers look for on the applications. This makes it easier to be prepared with this information so that you can fill out your life insurance application quickly and accurately. You can download an example life insurance application below and see what one looks like.

Some Common Life Insurance Application Questions

When you fill out your life insurance application, you will be asked questions about a variety of topics. Some of them are information that you have readily available. This type of information will include:

- Personal Information – Your name, date of birth, address and phone number details, social insurance number, marital status

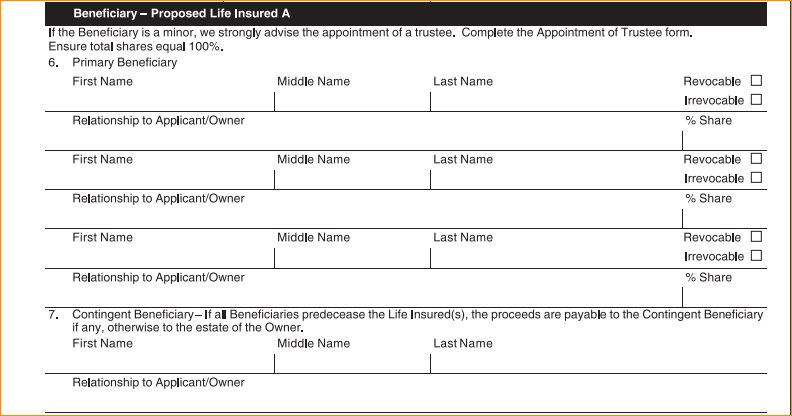

- Beneficiary information – You will name the person to whom you would like to receive the death benefit if the policy pays out on the application. You also have the opportunity to name a contingent beneficiary and trustee for any beneficiaries who are minors in this section of the application.

- Policy Details – This is where you detail what type of policy you are applying for (term or permanent as an example), how much the death benefit amount will be and if you’re applying for term insurance, how long the term periods will be.

Some of the information you need to fill out your life insurance application may be things that you need to think about a bit more or even do a bit of searching to find out. These topics will include:

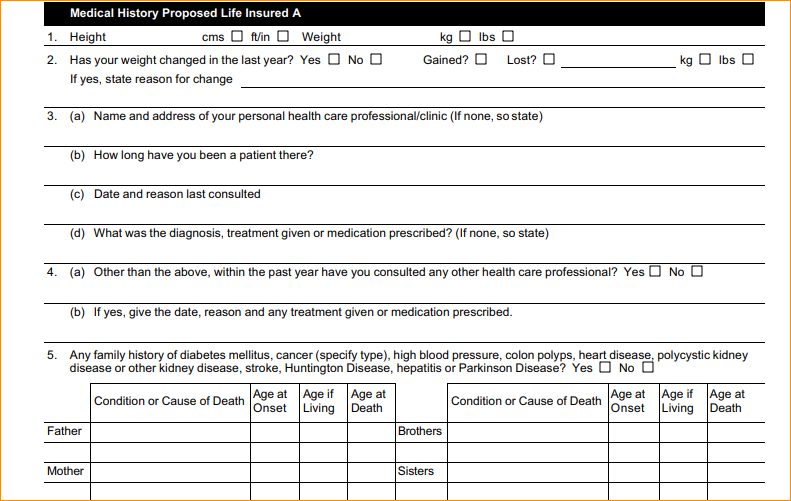

- Health Information – You will be asked about your personal medical history. This will include things like when and why you last saw the doctor, any current health conditions, what medications you are currently taking, what the doses are and any treatments you are currently undergoing. You will also need to disclose any medical tests that you have had recently or if you have any tests scheduled but not yet completed. They will also ask you about the medical history of your direct family members, so knowing the history of your parents and siblings will make completing this part of the application easier.

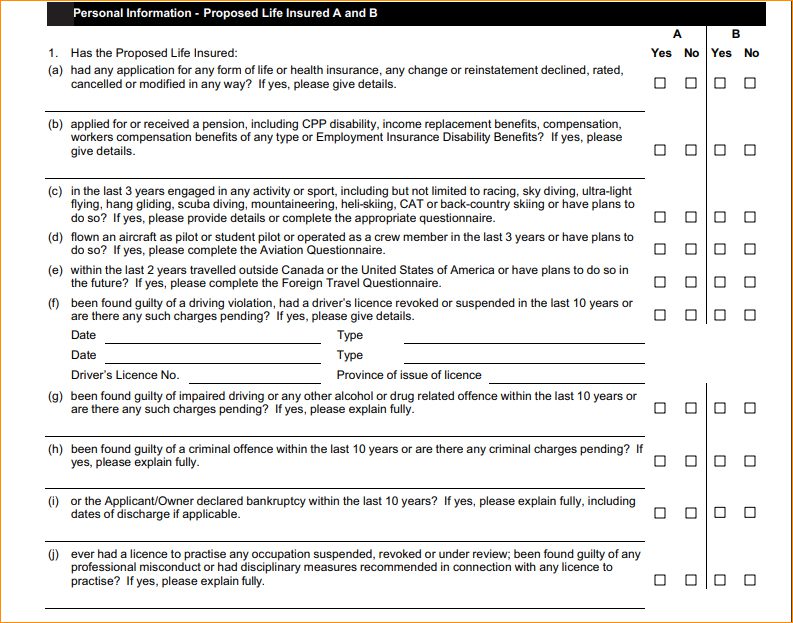

- Lifestyle – The insurer will ask you about a few different things that relate to how you spend your time. They will ask you about any hobbies that you have that may be considered dangerous (like that skydiving team you’re part of) as well as your history of travelling. This is to get a feel for how you spend your time. They will also ask about your history of nicotine and/or cannabis use here to determine if you qualify as a smoker or non-smoker. One final thing that they may ask about is your driving history. For example, have you ever been charged or convicted of DUI, speeding tickets, or driver’s license suspensions? If any of these are in your history, know the details about when they happened and what the charges were (i.e. speeding at 15 km/h over the limit) because this is information that you will need.

- Occupation – They will ask you what you do for work. Who you work for and what your job entails are details that can play a role in underwriting decisions.

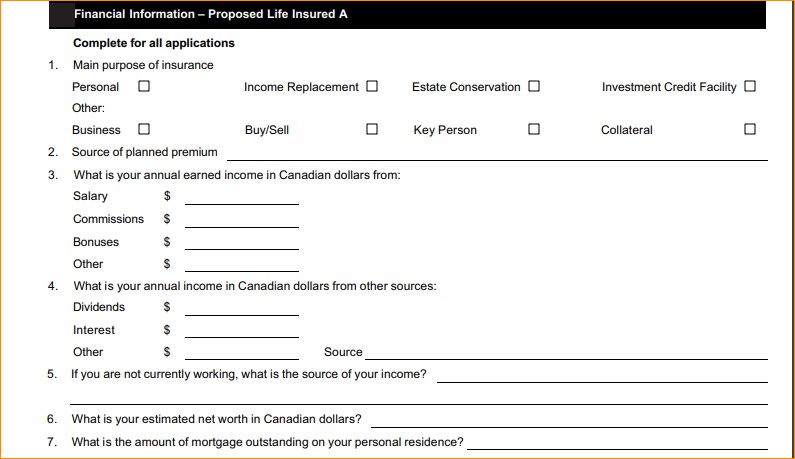

- Financial Information – Your income and net worth will be requested. From an insurer’s perspective, they want to avoid a situation where a person is ‘worth more dead than alive.’ How much income you make and what you own are both important factors in making sure that this doesn’t happen.)

- Existing Insurance Policies – Details on any existing life insurance policies that you have will also be requested. You will need to know the amount of coverage and what insurance company issued them to complete the application.

How to Fill Out a Life Insurance Application

Here is a step-by-step example of what you will see on a life insurance application. As you can see, some sections are very straightforward, but there are some where, if you answer yes to the questions, you will need to provide additional information.

Key Sections that you will need to fill out on your life insurance application will be:

- Personal Information

- Name and Contact Details

- Social Insurance Number

- Date of Birth and Gender

- Marital Status

- Beneficiary Information

- Primary Information

- Contingetn Beneficiary

- Beneficiary Contact Information

- Policy Details

- Type of Policy

- Coverage Amount

- Policy Term

- Health Information

- Medical History

- Current Health Conditions

- Medications and Treatments

- Family Medical History

- Lifestyle and Occupation

- Occupation and Income

- Hobbies and Lifestyle Habits

- Travel History

- Financial information

- Income and Employment Details

- Assets and Liabilities

- Existing Insurance Policies

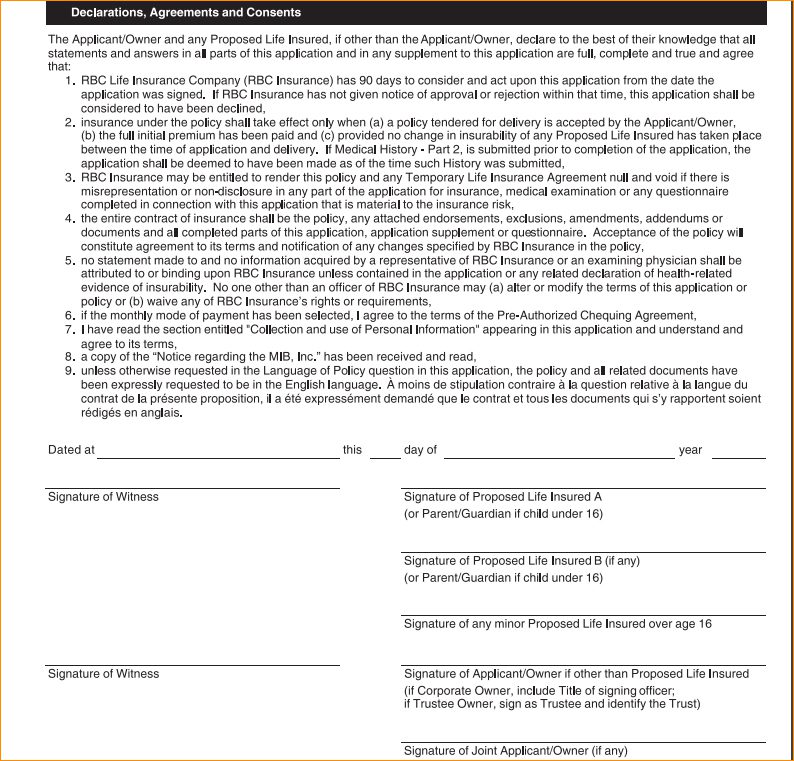

- Declarations and Signatures

- Applicant’s Declaration

- Authorization to Obtain Information

- Signatures and Date

Steps in the Life Insurance Application Process

Filling out your life insurance application is the starting point of the process that you hope results in the insurer issuing the policy you have applied for. The entire process may consist of more steps. These are detailed below.

Step 1: Initial Application

This is where you fill out the actual application and is the first step in the application process. It provides the foundation for the underwriters at the insurance company to come to their decision.

Step 2: Medical Exam

Depending on how much coverage you’ve applied for and the insurance company’s guidelines, you may be asked to have a medical exam completed. This can include things like having blood drawn and providing a urine sample for analysis. If required the insurer will have a company that will work with you to carry out the medical exam.

Step 3: Underwriting

Using the information from when you filled out your application along with the medical exams, the insurance company underwriters will make a decision on whether or not to issue your policy.

Step 4: Approval/Denial

You can be approved for coverage in three ways:

- Standard – the policy is issued as you applied for it, with the coverage and premium amounts the same as originally expected

- Preferred – some insurers will offer lower premiums than originally calculated based on the health and lifestyle assessment.

- Rated – this is a situation where the underwriters determine that they would accept the application but they need to charge a higher premium than originally calculated based on the information that they received with the application.

The fourth outcome that the underwriters can arrive at is denial of the application. This is what it sounds like the decision is that the insurer is not willing to take on the risk, so they decline the application.

Step 5: Policy Issuance

Assuming that the policy is approved, the insurer will then issue the actual policy document and send it out to be delivered to you as the owner. All policies include something called the ten-day free look. This is a window for you once you receive the policy to make sure that you understand all of its terms and conditions. If you see something you don’t like during the free look period, you can return the policy and have any premiums you have paid refunded.

How Long Will It Take For A Decision To Be Made On My Life Insurance Application?

There are a number of factors that can influence how long your application takes. Filling out your life insurance application completely and accurately definitely expedites the process, but there are other outside factors that can affect how long it takes to get your underwriting decision. Some of these factors are outlined in a previous article we have written. You can find that post how long life insurance application decisions take. We have included a table here for your reference that shows the average time approvals take across Canada from life insurance companies.

Table: Average Time For Life Insurace Application Approval

| Province | Average Approval Time (Weeks) |

| Alberta | 3-5 |

| British Columbia | 2-4 |

| Manitoba | 3-5 |

| New Brunswick | 3-5 |

| Nova Scotia | 2-4 |

| Ontario | 2-4 |

| Quebec | 3-5 |

| Saskatchewan | 2-4 |

What Happens After You Submit A Life Insurance Application?

Now that you’ve successfully filled out your life insurance application, what are the next steps?

- The broker you are dealing with will electronically submit your application to the insurer you are applying for coverage with.

- Underwriting will review the application and determine if they need any additional information based on the answers you provided. They may schedule a telephone interview with you as part of this process to get clarification from you on points they need more information on.

- Depending on how much coverage you are applying for, you should be prepared for a potential medical exam to assess your health more in-depth and make sure that you are eligible for coverage.

- Medical Examination (if required)

- Scheduling the Exam – You will be contacted by a company approved by the insurer, who will arrange to send a medical professional (typically a nurse) to meet with you.

- What to Expect – You will likely be asked some medical questions again by the nurse; they will conduct some exams, such as how tall you are and how much you weigh. They will test things like your blood pressure and then collect any blood or urine specimens that the insurer requires for underwriting.

- Tips for a Successful Exam – Schedule this exam at a time that is convenient but also when you will be ‘at your best’. This means trying to avoid having just consumed an entire pot of coffee (for example) right before an appointment when someone is going to take your blood pressure. Also, being hydrated always helps when it comes time to collect blood or urine samples.

- Medical Examination (if required)

Life Insurance Application Process by Province

The insurance industry is provincially regulated. This means that each province in Canada has its own set of unique regulations and requirements for how they handle life insurance applications. Having an understanding of what to expect in the province you are applying for life insurance in will help you manage your expectations for how the application process will work.

This table provides an overview of who the regulatory bodies are and the medical exam requirements for life insurance applications in different Canadian provinces:

Table: Comparison of Life Insurance Application Processes Across Canadian Provinces

| Province | Regulatory Body | Medical Exam Requirement |

| Alberta | Alberta Insurance Council | Usually required |

| British Columbia | Financial Institutions Commissions (FICOM) | Generally required for higher coverage amounts |

| Manitoba | Insurance Council of Manitoba | Generally required |

| New Brunswick | Financial and Consumer Services Commission (FCNB) | Often required |

| Ontario | Financial Services Regulatory Authority (FSRA) | Often required depending on coverage amount |

| Quebec | Autorité des Marchés Financiers (AMF) | Typically required |

| Saskatchewan | The Insurance Act | Often required |

Benefits of Properly Filling Out a Life Insurance Application

The information that you provide when you fill out your life insurance application forms the basis of the entire underwriting process, and having a properly filled-out application will help you. The benefits of having a properly filled out life insurance application can include:

- Accurate Coverage: You know that the coverage you want is what you are going to get. For example, you don’t want to accidentally apply for permanent coverage when what you really wanted was a term plan.

- Lower Premiums: With accurate health information, your chances of receiving preferred rates increase.

- Faster Approval: If the underwriters don’t have to ask follow-up questions, they are able to arrive at their decision faster.

- Avoiding Rejection: This is where working with a broker can help. An experienced broker, like the ones at LifeInsuranceCanada.com will help when they apply their expertise to help with your application. Having industry experts helping you avoid potential mistakes when you fill out your life insurance application will help you avoid potential rejection of your application.

- Financial Security: Having a properly filled out application for life insurance that makes the underwriting decision happen quickly and this makes it so that you have the financial security associated with the policy being in place faster.

- Peace of Mind: Filling out your life insurance application accurately and completely gives you the peace of mind in knowing that the underwriters had all of the information that they needed to complete their portion of the plan and that, when the policy is issued, you know that it will be in place.

The Importance of Completing A Life Insurance Application Accurately

Tony Steuer, CLU, LA, CPFFE is an internationally recognized financial preparedness advocate, and author of “Questions and Answers on Life Insurance,” emphasizes the importance of completing your life insurance application accurately:

“Your life insurance application is one of the most critical documents you will ever fill out. Ensuring it is completed accurately and honestly is essential for securing the coverage you need and avoiding future complications or denials.”

10 Common Mistakes to Avoid When Completing a Life Insurance Application

With years of experience helping clients fill out their life insurance applications, here are some common mistakes that we have seen and how to avoid them:

- Providing inaccurate personal information: The most common errors with this information are often based on attention to detail. Making sure that you have entered the ‘month’ and ‘day’ in the right spaces on your birthday is an example where you could potentially make yourself a year younger or older unintentionally.

- Omitting health history details: Thinking that something was ‘no big deal’ so you leave it off the application is never a good choice. If it was minor, the underwriters will understand that. Not disclosing a health condition can lead to major problems down the road.

- Underestimating lifestyle risks: If you participate in activities like scuba diving or like to travel to places ‘off the beaten path,’ you may underestimate the risks as they apply to increasing the risk for a life insurance company.

- Incorrectly listing beneficiaries: Remember, if it gets to this point and we are contacting beneficiaries, you are no longer around to tell us that wasn’t what you meant! Make sure that you clearly define who you want policy proceeds paid to in the event that you pass away.

- Misrepresenting financial information: Having an accurate picture of your life financially will aid in determining why you are applying for the amount of coverage you are. This is also where having a needs analysis completed paints a financial picture for the underwriters to understand why you need what you are applying for.

- Failing to include all doctors and medical visits: The big one here is tests that are scheduled but not yet completed. Yes, we understand that the MRI you have been told to have is related to a shoulder injury and not an illness. At the same time, certain medical conditions can be seen in these types of tests even when they aren’t what you are looking for. Having accurate information about your medical information is essential to this process.

- Neglecting to mention other insurance policies: If you’ve completed your needs analysis and it shows you need a million dollars of coverage and you apply for that amount and neglect to disclose that you already have a policy that would pay half a million dollars if something happened to you, it gives the appearance that you may be trying to mislead the insurer, even if that’s not your intention you never want to give that impression.

- Not reviewing the application thoroughly: Take a few minutes to make sure that you’ve been accurate so there are fewer potential follow-up questions.

- Rushing through the application: Read the questions. This is the best advice here. If you are rushing, you may miss one of the health conditions in one of the questions. Sometimes, the lists of what they are asking you if you have it are long. You don’t want to accidentally make a mistake because you didn’t have the time to read the application thoroughly.

- Ignoring follow-up questions from the insurer: If the insurer comes back to you requesting a follow up to your application it means they need clarification on something before they will render any decision. If you don’t answer them, they proceed without the information, and you may be unhappy with the decision based on incomplete information.

Dealing With Application Issues

There is the potential for a variety of different issues that can arise with your application, and the potential is there that it could result in a decision you don’t agree with. Just because of one decision that doesn’t go your way, though, you still have options. Here are some examples of issues you could face and how to deal with them:

- If Your Life Insurance Application Is Declined – you are within your rights to request an explanation of why the coverage was declined. The insurer may choose to send the explanation to your family doctor, but you could then go and discuss with them to see what the reasoning for being declined was. There are options that are still open to you as well, including things like simply trying a different insurance company or taking out a guaranteed issue policy.

- If the Application Gets Rejected – This is different than a decline to offer coverage. If your application has been rejected there’s a chance it didn’t contain enough information to make it through the initial pre screening before the underwriting. Make sure that there wasn’t something like a typo in the birthday section of the application that accidentally made you too old to apply for life insurance.

- Missing Information / What Happens If the Application Is Incomplete – If there is missing information from your application you may be contacted by the insurer to arrange a phone interview to collect the information or your broker may receive a request for more information. In either case, make sure that you reply to the request in a timely manner so that the application is processed.

- Incorrect Information – If there is incorrect information on the application that you notice you need to notify the broker right away. They will pass this along to the insurer to make sure that the correct information is included in their process. As long as the incorrect information was provided inadvertently and not an attempt to intentionally mislead the insurer you should be able to continue with your application.

The Most Common Error

“The most common error in preparing the application is the failure to complete it. Leaving responses blank, failing to provide requested supplements, or providing nonresponsive answers can delay or even derail your application.” Caroline F. Crosby, from Phelps Dunbar LLP, Article: Full Disclosure – Tips on Completing Your Insurance Application

There are common themes amongst problems that arise when people complete their life insurance applications. It’s not necessarily that someone is trying to intentionally mislead the insurer; more often, it is just that they don’t understand the degree to which they need to provide details for the underwriters. Here is a table that shows some of the common reasons for life insurance application rejection:

Table: Common Reasons For Life Insurance Application Rejection

| Reason | Description |

| Incomplete Information | missing personal, health or finanacial information |

| Inaccurate Health History | discrepancies in medical report |

| High-Rish Lifstyle | dangerous activities or occupation |

| Existing Health Conditions | pre-existing health issues not disclosed |

| Financial Instability | insufficient financial info or bankruptcy |

Tips for a Successful Insurance Application

To help make sure that your application is successful, there are a few tips that you can follow. Things to make sure you do when you fill out your life insurance application include:

- Provide Accurate Information: make sure personal and health details are accurate and complete.

- Be Honest: Never try to mislead the insurer, this is an application that falls under contract law and attempting to mislead the insurer constitutes fraud on the application and can result in the cancellation of your policy in the future.

- Prepare Documents: Having information about things like what medications you take and their dosages prepared will make the application much easier to complete.

- Work with a Agent/Broker: Your life insurance Agent is experienced with filling out many life insurance applications. Take advantage of their expertise to make sure that your application is completed properly.

- Understand the Policy: Know what you are applying for and why you are applying for it.

- Review Application: Take the time to double-check the application for accuracy.

- Follow Up: If the insurer or your agent sends you a request for more information make sure you answer it promptly.

Trends In Canadian Life Insurance Application In 2024

Overview

When we look at trends in the life insurance industry in Canada, we see that there is a notable increase in the number of applications being made for coverage. This indicates that Canadians are becoming more aware of the importance of life insurance as part of their overall financial security plan. Life insurance is more accessible today than ever before, and Canadians have taken note of its importance, leading to more people applying for coverage than ever before.

Increase in Life Insurance Applications

According to the MIB Life Index, Canadian life insurance application activity saw a significant rise of +6.5% Year-over-Year (YOY) in May 2024 compared to May 2023. Year-to-date (YTD) activity through May 2024 also increased by +8.5% compared to the same period in 2023. However, on a Month-Over-Month (MOM) basis, May 2024 activity was down by -4.9% compared to April 2024.

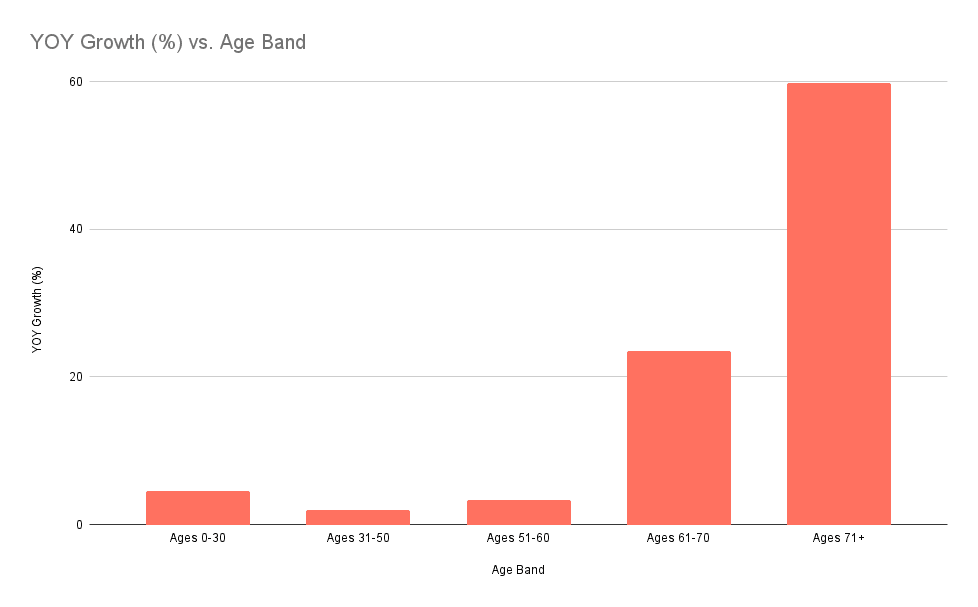

Growth Across All Age Bands

For the second consecutive month, May 2024 saw YOY growth across all age bands:

| Age Band | YOY Growth (%) |

| Ages 0-30 | +4.5 |

| Ages 31-50 | +2.0 |

| Ages 51-60 | +3.4 |

| Ages 61-70 | +23.5 |

| Ages 71+ | +59.8 |

When we see growth like this across the industry, it shows how many people recognize the value of life insurance in Canada. In particular, the double-digit increases in the age group for those aged 61 and above show how people of all ages now recognize the value of life insurance in Canada. For more details on the increasing volume of life insurance applications in Canada, you can refer to the MIB Life Index report.

Expert’s Viewpoint

“With more Canadians recognizing the value of life insurance, insurers are seeing an increase in the volume of applications they are processing. In order to make sure that your life insurance application is processed quickly, you want to make sure that you do it the right way. Working with our agents will help you with this and give you the best chance of a fast, favourable outcome from underwriting.”

Infographic: Best Practices For Filling Out Your Life Insurance Application

Case Studies

Case Study #1

Scenario: During the application process, the prospective policy owner is asked whether or not they have any medical tests scheduled but not yet completed. The answer that they provide is no, thinking that this is accurate. The problem that arises is that they have an MRI scheduled on an injury sustained from a fall on the ice while coaching their child’s hockey team. The applicant does not think of this as a ‘medical test’ because the injury wasn’t related to a health concern.

Outcome: This application was postponed until the results of the MRI became available. The reason for underwriting was that while the soft tissue injury wouldn’t affect the decision, there is the potential that the MRI would reveal some other health concerns that currently show no outward symptoms. Once the MRI results became available, the underwriter requested that the person reapply for coverage.

Case Study #2

Scenario: While applying for life insurance, an applicant stated that they were a non-smoker. This was due to the fact that the premium for smokers is higher than for non-smokers, and the person felt like they were only an ‘occasional smoker.’

Outcome: The application required a medical exam. The test results for this showed markers that indicated that the application was a user of nicotine products. As a result of the inaccurate information provided on the application was denied and no coverage was issued.

Case Study #3

Scenario: Working with an experienced life insurance broker an applicant was guided through the process of completing their life insurance application completely and accurately. This included disclosure of what the applicant considered ‘minor’ health issues that they would have left off the application if it wasn’t for the expert guidance provided to them.

Outcome: Taking advantage of the complete information provided to them the underwriters were able to render a fast decision to issue the policy.

Frequently Asked Questions

Here are some frequently asked questions regarding filling out your life insurance application:

What if I have pre-existing conditions?

A: Disclose them. Simply having pre-existing conditions won’t exclude you from getting life insurance. Failing to disclose them on the application will result in your being excluded, though.

How long does the approval process take?

A: This depends on a few factors, some of which you control. The ones you control are making sure that your application is complete and accurate and that you follow up quickly with answers to any additional information requested by the insurer.

Can I make changes to my application after submission?

A: If you realize after an application that you made a mistake on it your agent should be able to get the corrected information to the underwriters along with an explanation of why the mistake was made.

How long does it take to complete a life insurance application?

A: The entire application can typically be completed in 30-60 minutes. Having the information on your medical history and lifestyle history ready in advance definitely helps keep this toward the faster side of the equation.

Can I cancel a life insurance application?

A: You can cancel the application at any point in time.

How Do I Apply For Life Insurance?

Now that you know how to complete a life insurance application, let’s get you started on how to apply for life insurance. Check out our previous article, “How do I apply for life insurance? To help with the next steps that you need to take to get your life insurance application going.

Conclusion

As mentioned previously, your life insurance application forms the basis for the underwriting decision when you apply for life insurance. Making sure that you have filled the application out completely and accurately will help you avoid unnecessary delays in the process and help you get approved faster for the policy. Working with agents like the team at LifeInsuranceCanada.com will help you make sure that the information you fill out on your application will help you get the speedy resolution to your policy that you want.