Overview: How Much Life Insurance Do Parents Need in Canada

- Introduction: Why Life Insurance Is Essential for Canadian Parents

- Types of Parents Who Should Consider Life Insurance

- Key Stats That Show Canadian Families Are Underinsured

- Everyday Costs Life Insurance Helps Cover for Parents

- DIME Formula is a Simple Way for Parents to Figure Out How Much Life Insurance They Need

- How Much Is Enough? Estimating Coverage Based on Family Size and Income

- How the Canada Child Benefit (CCB) Fits Into Planning

- Major Financial Obligations: Mortgage, RESP and Debt

- Term Life Insurance for Parents: Affordable Protection for Critical Years

- Permanent Life Insurance: When Long-Term Coverage Makes Sense

- Life Insurance for Stay-at-Home Parents

- What If One Parent Has Health Issues? Adjusting the Strategy

- Comparing Quotes: Tools and Tips for Canadian Families

- Common Coverage Mistakes Parents Make (and How to Avoid Them)

- Expert Insights: What Canadian Life Insurance Advisors Want Parents to Know

- Top 5 FAQs About Life Insurance for Parents in Canada

- Case Study: Two Canadian Families, Two Very Different Coverage Plans

- Downloadable PDF: Life Insurance Needs Calculator Worksheet for Parents

- Conclusion: Get the Right Policy—Protect Your Children’s Future With Confidence

Introduction: Why Life Insurance Is Essential for Canadian Parents

When you become a parent you need to plan for the unexpected. This is why you carry around a diaper bag, always pack way too much for a weekend away and never know for sure if you’re going to get to watch the whole movie at the theatre. Becoming a parent means two things. The first is that you are always making plans, and the second is that it also means that you need to always have a contingency in place for when your plans go awry and the unexpected happens. No one becomes a parent thinking that they are going to die unexpectedly and not get to see their kids grow up. Unfortunately, this is a possibility and it is one that you need to plan for the same way that you plan for the unexpected by taking that extra change of clothes for the kids on their play dates. If you were to pass away unexpectedly there are still bills to pay, often these bills were based on two parents having an income to fund them when they were set up, and now that isn’t the case. The thing is, you can’t only pay half your mortgage because your family income has decreased because someone has died. Sound stressful? You bet it is. The good news is that there is a simple solution that is available to you. Buy yourself life insurance.

This is the best way for parents to plan for the unexpected and make sure that their loved ones are looked after financially. Parents should have life insurance to make sure that if something happens to them that their family can pay their bills, pay off debts and help fund future education expenses. How to apply for life insurance is simple but the thing that I find astonishing is that there are families out there that don’t have life insurance. If you are a parent you should think of life insurance as a must-have financial security plan. Not something that is optional, life insurance for parents is a must.

Life insurance is easy to find and easier than ever to apply for in Canada. Why then, according to the Canadian Life and Health Insurance Association (CLHIA), is it the case that “Only 55% of Canadian parents with children under 18 have individual life insurance—leaving many families unprotected.”? The scale of things that can go wrong with your family if a parent dies unexpectedly without life insurance is massive. Not only is there lost income for your household but there are still bills to pay and the additional costs of things like the funeral. And let’s face it, the cost of living in Canada is not going down. The idea of only one income funding just the daily living costs can be daunting, let alone saving for things like postsecondary education in the future. Add on to the saving for the future aspect that, even after one parent passes away, the surviving parent likely wants to be able to retire someday and you can see that there are major challenges to surviving family members of parents that don’t have enough life insurance. Parents often think things like ‘I have coverage through my work’ or ‘we have enough savings to offset anything unexpected’ but this is rarely the case. In most cases, even parents who have life insurance in place may have underestimated how much coverage they need in order to maintain the lifestyle of their children and make saving for their education possible.

We are going to take a few minutes to look at life insurance policies for parents. We want to make sure that you understand what types of life insurance for parents are available to you and that you know how to figure out how much coverage you need. We will take some time to address the different types of policies available for parents and go over some samples to show how policies can look for parents. Finally we will take a few minutes to provide some tips to help to make sure that you can avoid some of the common mistakes we have seen parents make when they are setting up their life insurance plans.

Overall we want to make sure that as a parent who is seeking out life insurance that you understand that life insurance for parents isn’t complicated. It also isn’t too expensive to be worth owning. These two opinions that we often encounter simply aren’t true and hopefully, when you’re done reading you will also see how owning life insurance for your family is a simple, cost effective way to provide you with the peace of mind that your family is looked after financially in the event that the worst case scenario happens to you.

2. Types of Parents Who Should Consider Life Insurance

You may or may not have heard of this before but the idea of the ‘Millionaire’s Family’, this was the idea that the ideal family consisted of a family with one daughter and one son and two parents. This was the ‘ideal’ combination for having kids. The reality is that the family structures that we see in Canada have changed substantially over the years. The one thing that remains the same though is the need for all parents to own life insurance. Regardless of how your family is set up there is a significant need for parents to own life insurance to make sure that their families are looked after financially if they die unexpectedly. In some cases the way that families have changed only increases the need for parents to own life insurance. Let’s look at a few examples of family structures and how they can affect the need for parents to have life insurance:

- Dual-Income Parents

This is the historical idea of the ‘nuclear family’. A couple with kids where both parents work. In this situation the family needs to consider how easy it would be to support their lifestyle if one of the parents passed away and they were reduced to a single income. - Single-Income Families (One Breadwinner, One Caregiver)

In a single income household where there are two parents you still need to consider the financial impact of the loss of the non-income earning parent. The role that they play in the family is essential and if they weren’t available to carry out these responsibilities there would be a severe financial impact on the family. - Single Parents

With a single parent they need to consider the financial impact of raising their children on the guardians that they appoint. Suddenly adding your children to someone else’s home could have a severe financial impact on that house and you need to provide them with support. - Stay-at-Home Parents

While stay-at-home parents do not earn an income, there is a real value associated with the work they do rearing their children. If they aren’t around to do this then there will be a financial impact on the family unit. - Blended Families

Blending a family includes the financial support needed for children in the event that they lose a parent, biological or otherwise. Depending on the guardianship of the kids you could leave a real financial burden on your surviving partner to care for a larger family than they are capable of alone. - Parents of Children With Special Needs

These parents face the reality that as their children grow older there are costs that will continue beyond the typical time frame of when children become self-sufficient. - Young Families With Newborns or Toddlers

At this point in the timeline of a young family, the costs of raising children are the highest so financial protection for the parents is a must. - Older Parents With Teen or Adult Dependents

If you are in a situation where you have older children or adult dependents you need to account for the costs that come with supporting them as long as they will require assistance. - Business-Owning Parents

If you own a family business and would like to pass it along to your children, life insurance can play a really important role in funding the taxes on the transition of the business from one generation to the next. - Low-Income or Recently Separated Parents

Similar to single income families. If you are low income or if you are recently separated you need to have life insurance to make sure that your children are looked after in the event that you pass away. This prevents them from becoming a burden on their guardians after you are gone.

3. Key Stats That Show Canadian Families Are Underinsured

Most Canadian families are under insured (if they have any life insurance coverage at all) and they are confused when it comes to determining how much coverage they actually need. People forget that the amount of life insurance that you need changes over time and that you need to review regularly to make sure that the amount of coverage that you have keeps up with what you need.

Canadian Family Demographics

According to Statistics Canada, there were over 3.5 million families in Canada in 2023 raising children aged 17 or under, representing a large portion of Canadian households with active dependents. This number continues to grow each year, highlighting the widespread need for financial protection through life insurance.

- 3,561,850 families with children aged 17 and under in 2023

- 971,820 families with children aged 5 and under

- 1.2 million families with children aged 6–14

- 319,290 families with teens aged 15–17

Source: Statistics Canada. Table 39-10-0041-01 – Families with children by age of children in the family. 2023.

Dual-Income vs. Single-Income Canadian Families (2023)

In 2023, there were approximately:

- 5.46 million dual-earner couple families

- 1.52 million single-earner male couple families

- 802,400 single-earner female couple families

- 1.03 million one-parent families

As of 2023, over 5.4 million Canadian families relied on two incomes, while around 2.3 million operated with just one. This reflects a strong national trend toward dual-income households emphasizing the need for life insurance coverage for both partners in case one income suddenly disappears.

Source: Statistics Canada. Table 11-10-0028-01 – Single-earner and dual-earner census families by number of children. 2023.

Single-Parent Family Statistics (2021–2024)

“In 2021, 16.4% of Canadian families were led by a single parent—over three-quarters of them are single mothers—demonstrating the prevalence of families managing on one income.”

One‑Parent Families

- 16.4% of Canadian census families were single‑parent households in 2021, up from 13.0% in 1991, then stable around 16.3% since 2011

- Women led 77.2% of these one-parent families, while fathers led 22.8%, reflecting a small but meaningful increase over the decades (Statistics Canada)

- Nearly 1 in 5 children under 15 (19%) lived in a one-parent family, highlighting why this demographic faces different financial pressures (Statistics Canada)

Growing Role of Fathers

- The share of single-father households climbed from 17.3% in 1991 to 22.8% in 2021, showing more men taking sole caregiving roles over time

Multigenerational Households

- While not directly related to parent coverage needs, data shows 442,000 multigenerational households in 2021, housing 2.4 million people, and growing faster than other household types—underscoring expanding caregiving networks in Canada

Source: The Vanier Institute of the Family. Families Count 2024: Family Structure, Chapter 11—“Fathers represent a growing share of parents in one-parent families.” (2024), citing Statistics Canada 2021 Census data.

Blended (Step) Families in Canada

In 2021, about 8.4% of Canadian couple‑families with children were blended families and over half a million households. Common‑law relationships showed a higher prevalence of stepfamily structures (31% compared to 7.3% among married couples). These dynamics are important to consider when planning for life insurance needs tailored to blended family responsibilities.”

Source: As cited in Families Count 2024: The Vanier Institute of the Family, Chapter 9 “ Pathways to becoming a stepfamily have evolved.”

Average Number of Children

“On average, Canadian families with children have about 1.8 kids, and the typical household consists of nearly 3 people. That means most parents in Canada are responsible for at least one child—and often more—making sufficient life insurance essential for long-term planning.”

4. Everyday Costs Life Insurance Helps Cover for Parents

If you were to die, the proceeds from your life insurance policy help the people caring for your children cover the financial responsibilities that go along with raising your children. This includes all kinds of things. Costs associated with housing, food and clothing are the most basic but think about the other things that you currently use your income to pay for. A couple of the bigger examples are extra curricular activities and saving for post secondary education. These costs carry on even if you are no longer around so you need to have a plan that will help you provide the financial support necessary to look after your children even if you aren’t around with your income to provide that support in the future. In order for parents to figure out how much life insurance they need you should consider the following:

Expenses your family would still face:

- Income replacement: Your family expenses are often set based on what can be supported by the income of both parents. If one parent dies the expenses don’t drop because the family income does. You should consider what still needs to be paid even if you are gone and your income has stopped.

- Mortgage or rent: This is a big one. Again, your mortgage or rent payment doesn’t decrease when someone dies. This means that you need to include funding for how to pay these expenses in your analysis of how much insurance you need.

- Credit card debt: Credit cards typically carry high interest rates, so paying them off on a single income can be quite difficult.

- Loans (personal, car, student): Again this is an example of things that don’t decrease when your family income decreases due to someone passing away. These payments will remain at the same amounts and you need to have a plan to pay them when only one income is being earned.

- Childcare costs: This is an example of an expense that can actually increase when one parent passes away. When the newly single parent returns to work they no longer have a partner to rely on to help with at-home child care. This means paying for a service that you didn’t necessarily require in the past.

- Groceries and bills: While it is true that if you were to pass away the cost of providing food for one member of the family is gone, but the truth is that, as any Canadian realizes after what happened to food prices in 2024 and 2025, these aren’t costs that are decreasing any time soon.

- Children’s education: Saving for the future on one income when your household expenses aren’t reduced proportionally to the loss of income becomes exceedingly difficult. If saving for post-secondary education for your kids is a priority you can build that into what you need for life insurance.

- Family medical expenses: Again these are costs that aren’t linked to how much you earn as a family. If you had a medical expense that was ongoing before you pass away, that bill will continue and you need to account for it.

- Household help: This is another example of something that maybe didn’t exist before, but if one parent passes away the surviving partner may need extra help around the house to maintain things now that the work that used to be split is the responsibility of one person.

- Transportation: This is a simple one. Having reliable transportation is a must have for most families. The downside to transportation is that it is simply a cost. You have car payments that need to be made or fees associated with public transportation, taxis or ride sharing. Whatever the mode is, there are costs associated with transportation that you need to consider.

- Funeral costs: Depending on the type of funeral arrangements that are made you can easily run into $15,000 or more for a funeral bill. If you want to have this type of funeral taking into consideration how much it will cost and adding it to your analysis of how much life insurance you need will greatly decrease the financial stress on your family.

- Ongoing support for dependents: This lines up with all of the above mentioned considerations. Is there anything that you currently support with your income that you want to make sure is continued even if one parent passed away? If the answer is yes, make sure that you plan for this when figuring out how much life insurance you need.

The key take away from this is that you need to remember that ongoing expenses don’t go away when someone passes away. Instead the shift to the surviving parent. This means that you need to make sure that you have enough life insurance to support your family’s needs. This is one of the most important things that a parent can do when they take out life insurance.

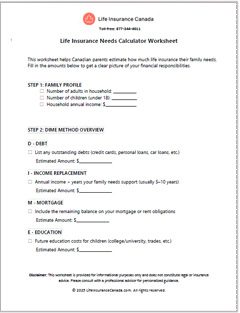

5. DIME Formula is a Simple Way for Parents to Figure Out How Much Life Insurance They Need

One of the biggest things that we encounter is families telling us that, when it comes to figuring out how much insurance they would need, they don’t know where to start. In order to simplify things, think of the DIME method. The DIME method is a simple and effective way for parents to estimate how much life insurance they may need. It takes into account four key areas that you need to consider if you are taking out life insurance. The DIME method asks you to calculate what you need in these four areas:

D – Debt: How much would it cost to discharge all of the debt that you have today?

I – Income replacement: If you weren’t around how much of your income would your family need to replace to carry on with their current lifestyle?

M – Mortgage: What would it cost to pay off the remaining balance on your mortgage?

E – Education: How much of a lump sum would you like to be able to provide for education savings?

If you have an idea of what these four DIME expenses would be, it gives you a great start to figuring out how much life insurance you need. Adding these amounts all up gives you a good idea of where to start when you are discussing life insurance with an advisor.

6. How Much Is Enough? Estimating Coverage Based on Family Size and Income

One of the most common questions parents ask is: “How much life insurance do I really need?” The answer to this question can be complicated and there is no ‘one size fits all’ reply. This is because everyone has a unique situation so asking questions about the following factors will help you figure out how much is enough.

Coverage depends on several personal and financial factors:

- Number and age of dependents: If you have a young family then the amount of support that they will need is more simply because of time. The younger your dependents are the longer they need financial support. The same is true of situations where there is a large number of dependents. More dependents simply require more support.

- Household income and whether you’re the sole earner: In a single income family there are often higher needs for the income earning spouse. This is because if the spouse that passes away was the one responsible for providing income then this needs to be replaced to make sure that the family can continue their lifestyle. It also needs to be considered that while yes, it is possible that the surviving spouse goes to work outside the home, how much they earn could be considerably different that the current amount of income.

- Outstanding debts: Things like your mortgage, car loans or credit card balances are all expenses that you can include to pay off in full as part of your death benefit. This can make a real difference for your beneficiaries because they would no longer need to worry about how they are going to pay off debts with the change in family income that accompanies the unexpected death of one of the income earners.

- Childcare and daily living expenses: When there are two parents in a home there are often ways to adjust schedules to help with childcare. If there is only one parent, this juggling becomes impossible because there is no partner to cover when you are unable to be there. This means that childcare expenses are likely to increase when only one parent is available, adding to daily living expenses.

- Future education costs: Post-secondary education is an enormous cost. It isn’t simply paying tuition for your child. You have to consider housing costs, food expenses, books and transportation as other costs that need to be paid. If you already have an RESP that is fantastic, but if you don’t, perhaps allowing for a lump sum of money from a life insurance death benefit earmarked for education funding will help make post-secondary education more financially viable.

- Existing savings or investments: While you may have savings in place, do you really want to force your family to burn through them to offset lost income when you pass away? Most people that have money saved have a plan for how to use that money in the future. Rather than needing to delay the surviving parent’s retirement because you thought that you had enough savings to make it through something like an unexpected death, provide enough supplemental income to allow the surviving parent to continue saving for the future, even on one income.

- Spouse’s ability to earn income after your death: This is particularly prevalent in single income families. If a spouse has taken time away from working outside of the home to be a full time stay at home parent then their income earning potential may be reduced if they were required to return to the workplace. They simply have missed out on time to allow their wages to grow at a job outside of the home and this could result in lower earnings. Again, consider supplementing income to make sure that any reduced income earning potential is accounted for in your plan.

The reverse can be true as well. If the partner who earned the higher income is the survivor they may be faced with the reality that the increase in family responsibilities as a single parent no longer allows them to commit the same amount of time to their career and their income could be reduced.

Again, make sure that you consider all the potential variables in planning your life insurance policy as a parent.

Sample Coverage Estimates Based on Family Size and Income

As I mentioned previously, there is no sure-fire way to calculate what every parent needs for life insurance because every circumstance is unique and with that comes varying needs. We often get asked though for a ‘rule of thumb’ style of figuring out how much death benefit someone would need. If you are looking for a quick way to figure out what you may need before talking to an advisor about your personal situation consider these examples as ways to figure out an estimate for what you may need:

- For a single parent with young children, aim for 10 to 12 times your income.

- For a two-parent household, you may need 5 to 7 times your income per adult — especially if both partners are working.

The table below, “Estimated Coverage Needs”, offers a quick reference to help you visualize how income and family structure can impact your life insurance requirements.

Sample Coverage Estimates Based on Family Size and Income

The table below, “Estimated Coverage Needs”, offers a quick reference to help you visualize how income and family structure can impact your life insurance requirements.

Table: Estimated Family Coverage Needs by Family Type

| Family Type | Household Income | Suggested Coverage |

| Single parent, 1 child | $50,000 | $500,000 – $600,000 |

| Single parent, 2 kids | $60,000 | $600,000 – $720,000 |

| Single parent, 3+ kids | $70,000 | $700,000 – $840,000 |

| Two parents, no children | $80,000 | $400,000 – $560,000 per parent |

| Two parents, 1 child | $90,000 | $450,000 – $630,000 per parent |

| Two parents, 2 children | $95,000 | $500,000 – $665,000 per parent |

| Two parents, 3+ children | $100,000 | $600,000 – $800,000 per parent |

| Blended family, 4+ children | $110,000 | $650,000 – $900,000 per parent |

| Dual-income, no mortgage | $120,000 | $400,000 – $600,000 per parent |

7. How the Canada Child Benefit (CCB) Fits Into Planning

If you are raising children in Canada you may be eligible for the Canada Child Benefit. This is a monthly payment from the federal government aimed at helping families with the costs associated with raising children. The goal is for it to try and make life more affordable for parents. How much CCB you receive is dependent on your family income, the number of kids you have and how old they are. This benefit can fall into the income amounts that you use when you are determining how much life insurance to apply for as a parent.

How CCB Works:

Eligibility is based on:

- Adjusted family net income

- Number and age of children (under 18)

- Residence and caregiver status

You also need to continue to file your taxes every year to receive the CCB.

Who Qualifies for the Canada Child Benefit (CCB) and Other Federal Credits?

There are additional benefits that are available from the federal government to Canadian taxpayers. You need to be a parent to receive the CCB but there are benefits like the GST/HST credit and the Canada Carbon Rebate apply more broadly.

Here’s a simplified breakdown:

| Family Situation | Canada Child Benefit | GST/HST Credit | Canada Carbon Rebate | Provincial & Territorial Credits |

| Married or common-law, with children | Yes | Yes | Yes | Yes |

| Single parent with children | Yes | Yes | Yes | Yes |

| Married or common-law, no children | No | Yes | Yes | Yes |

| Single adult (19 or older), no children | No | Yes | Yes | Yes |

For 2025, the maximum annual benefit per child is:

- under 6 years of age: $7,997 per year ($666.41 per month)

- 6 to 17 years of age: $6,748 per year ($562.33 per month)

- Payments are made monthly, typically on the 20th of each month.

Source: Government of Canada, Canada Child Benefit: “How We Calculate Your CCB”

Canada Child Benefit Monthly & Annual Amounts

| Child’s Age | Max Annual Benefit | Approx. Monthly Benefit |

| Under 6 years | $7,997 | $666.41 |

| Age 6 through 17 | $6,748 | $562.33 |

How to Use CCB in Life Insurance Planning

The CCB isn’t enough money each month that you can ignore the need for life insurance benefits as a parent. It is something that you can include in your calculations for things like income replacement, but caution is needed. The thing to remember is that if you’ve been receiving the CCB since your children were born then that amount is likely already included in the amount of income you receive, so make sure that you can actually reduce your income need based on the CCB prior to applying it into any of your calculations.

Source: Canada Revenue Agency

Related Government Benefits for Families

Add In addition to the Canada Child Benefit (CCB), there are several other government programs that may support families, especially those with unique financial or caregiving situations:

- Child Disability Benefit (CDB) – The CDB is an extra monthly payment from the government for families caring for a child under the age of 18 who is eligible for the Disability Tax Credit.

- Canada Workers Benefit (CWB) – The CWB is a refundable tax credit the is designed to top up the income of low income workers. The idea is that if you are working, but a low income earner, that this benefit from the government will help you make ends meet.

- Children’s Special Allowances Program (CSAP) – The CSAP is similar to the CCB but is aimed at the support of agencies and foster parents who are caring for children that aren’t eligible for the CCB. It prevents these children from being left out of the support system implemented by the government.

8. Major Financial Obligations: Mortgage, RESP and Debt

Major financial obligations that many families have are a huge factor in the reason why parents should get life insurance. Your mortgage, saving for post-secondary education in RESPs and other debts you have are expenses that you need to consider eliminating with a life insurance death benefit because the ability to carry on paying these expenses after one parent passes away is often too burdensome on the surviving parent. For most Canadian parents, their largest financial commitments are mortgage payments, RESP contributions and outstanding debt. By making sure that you include these commitments in your life insurance planning you are making sure that you are protecting your family and their lifestyle should something unexpected happen to you.

Mortgage

Most often for Canadians the cost of housing is their largest monthly expense. Statistics show that the average value of a new mortgage loan in Canada reached approximately $356,800 in the first quarter of 2025. Including paying off any outstanding mortgage balances in your life insurance plan ensures that this expense is no longer an issue for your surviving family members and that they are able to stay in the current family home if they decide that is what they want to do.

Q1 2025 average new mortgage loan values by province:

| Province | Average New Mortgage (Q1 2025) |

| Alberta | $352,039 |

| British Columbia | $475,182 |

| Manitoba | $251,003 |

| New Brunswick | $215,625 |

| Newfoundland | $232,485 |

| Nova Scotia | $260,148 |

| Ontario | $441,074 |

| Prince Edward Island | $246,546 |

| Québec | $233,181 |

| Saskatchewan | $247,136 |

| Canada | $356,831 |

RESP (Registered Education Savings Plan)

RESPs are a powerful tool for saving for your children’s post-secondary education. With the grant money that the Canadian government deposits into these plans and the tax deferred growth on the investments in the plan they can be a major building block in your plan to save for your children’s education in the future. Often what we see is that when a parent passes away, if proper life insurance planning hasn’t been applied, deposits into savings plans like RESPs are stopped. This can be because of a variety of reasons, but most often it comes down to reduced cash flow needing to be applied to other areas (think living expenses). If saving for your children’s post-secondary education is a priority for you then you can use life insurance to make sure that your family’s savings goals are met, even if you aren’t there to see the end result. Including a lump sum that is allocated for your kids’ education can make sure that the goal is met, even without your income there to support it.

Average RESP Contributions per Beneficiary (2024)

Canadian families do make use of RESPs to help them save for their children’s post-secondary education costs. The average Canadian family will set aside about $1,840 per child in RESP accounts annually. There is a significant amount of funds in RESPs, by the end of 2024 there was nearly $90 Billion held in RESP plans across Canada. The popularity of these savings shows that for many families saving for their children’s education is a priority but If a parent unexpectedly passes away, RESP funding can stall while paying other bills becomes apriority on the newly reduced family income. Life insurance for parents is a key tool in keeping education savings goals on track.

RESP Data Table — 2024 Snapshot

| Metric | Canada (2022) | Canada (2023) | Canada (2024) |

| Total RESP Assets (billions) | $73.0 | $78.9 | $89.8 |

| Total Contributions Made (billions) | $6.1 | $5.9 | $6.2 |

| Average Annual Contribution per Child | $1.851 | $1,801 | $1,840 |

Debt

Paying off debt typically makes up a large portion of a household’s expenses in Canada. Mortgages, car loans, credit cards and student loans are all examples of debts that many Canadians pay regularly. I have mentioned it earlier but it bears repeating here, when many of these debts are entered into the decision to do so is family based and when that decision is made there is a known amount of income coming into the household. When one person dies the contribution that they were making to that income ceases, but the bills don’t. So if you lose half of your family income you don’t get to only pay half of your bills. Your bills remain at the same level and you simply need to find a way to make the payments happen with less money coming in. You can imagine how quickly these bills can become a burden on your surviving family members. When planning for how much life insurance you need as a parent make sure that you include enough in the death benefit to clear all the debts that you have so that your survivors can start off debt free, making the adjustment period to you being gone much easier for them in the long run.

Common debts parents in Canada may carry:

- Mortgage balance (primary residence)

- Home equity line of credit (HELOC)

- Car loans / vehicle leases

- Credit card balances

- Personal loans

- Student loans (parent’s own or co-signed for children)

- Lines of credit (unsecured)

- Retail store financing (e.g., furniture, appliances)

- Buy Now, Pay Later plans (BNPL)

- Tax debt (CRA repayment plans)

- Medical or dental financing (private clinics, orthodontics, fertility treatments)

- Small business loans (if self-employed)

- Family loans (money borrowed from relatives or friends)

Average Debt Owed By Canadians

| Q1 2024 | Q1 2025 | Yearly Percentage change | |

| Auto loans | $28,102 | $29,619 | 5.40% |

| Credit cards | $4,276 | $4,415 | 3.24% |

| Installment loans | $21,769 | $22,702 | 4.29% |

| Lines of credit | $34,239 | $35,183 | 2.76% |

| Mortgages | $360,335 | $376,185 | 4.40% |

By making sure that these debts are laminated you prevent your family from feeling pressured to make a decision about things like where they live while they are in the grieving process. This type of pressure being relieved can make a huge difference in how your family adjusts to you being gone.

9. Term Life Insurance for Parents: Affordable Protection for Critical Years

Hopefully by this point you see how important it is for parents to have life insurance in place. Particularly when you have young children who are dependent on you for financial support. That being said, one of the most significant push backs we hear from parents is that life insurance is simply too much money every month. This is where you need to take a look at what type of life insurance policy you are taking out. When insuring a need like income replacement that is needed while your children are young you need to remember that this is a need that goes away. As your family grows up they will become financially independent. This means that you need life insurance coverage that matches the need. Term life insurance is a great fit to cover yourself for temporary needs. Try and match the term length to the amount of time that you need the coverage for and you will find a cost effective method of providing your family with the life insurance coverage that they need.

Why Life Insurance Costs Vary for Every Parent

Life insurance isn’t one-size-fits-all — the price you pay depends on a few key things

- Your Age – The older that you are the more life insurance will cost. This is the most basic factor and it comes down to the fact that every year older that you get there is a slightly higher chance than the previous year that you will pass away.

- Your Health – If you are in good health you are more attractive as a risk to an insurance company. Remember, a life insurance company is in the business of taking calculated risk, and if you are in good health that risk is lower than if you have chronic health concerns that shorten your life expectancy.

- Smoking Status – Simply put, smoking leads to many health problems that will lead to a shorter life expectancy for you. If you choose to smoke you will pay higher life insurance premiums, even if you are ‘healthy’ today.

- Policy Length – Term policies have renewal periods built into them. The longer the renewal period that you select the higher the premium will be initially. You can look at lining up the length of the renewal period with the amount of time you need the coverage for to help ensure that you know upfront exactly how much your coverage will cost you.

Types of Term Policies & Options

Common term lengths (10, 20, 30 years) and why parents choose each.

| Term Length | Best For Parents Who Want Coverage Until… | Example Milestones |

| 10 Years | Short-term financial protection while paying off smaller debts or during a temporary income gap | Finish paying off car loan, cover remaining years of school |

| 20 Years | Protection until youngest child completes post-secondary education | Mortgage halfway paid, kids age 0–5 now will finish university by term end |

| 25 Years | Coverage until major debts and children’s education are fully complete | Full mortgage term, support children into early adulthood |

| 30 Years | Long-term security until close to retirement age | Large mortgage, blended families with younger children, late parenthood |

Average Coverage

The average life insurance coverage per household in Canada is $483,000 about five times the average household income.

Source: Canadian Life and Health Insurance Association, 2024 Factbook, p. 13.

Benefits for Parents

- Pays off mortgage or major debts.

- Maintains household income.

- Funds children’s education plans (e.g., RESP).

- Covers childcare and day-to-day living expenses.

- Protects family lifestyle and stability.

- Covers final expenses and funeral costs.

- Provides a financial cushion during adjustment.

- Reduces stress for surviving spouse or partner.

- Ensures dependents can pursue future goals.

- Allows time for surviving parent to retrain or change careers.

Key Numbers Every Parent Should See Before Choosing Life Insurance

Sample monthly premiums for a healthy male and female, non-smoker, for $500,000 coverage at different ages (e.g., 30, 40, 50).

What $500,000 in Term Life Insurance Really Costs for Canadian Parents

Rates are approximate and for illustrative purposes only. Actual premiums vary by insurer, health, and province.

| Age | Policy Type | Cost (Male) | Cost (Female) | Coverage Purpose |

| 30 | Term 10 | $20.25 | $13.95 | Short-term debts, new mortgage, young children |

| 30 | Term 20 | $29.25 | $20.25 | Covers until kids finish school/university |

| 30 | Term 30 | $42.98 | $31.79 | Long mortgage, long-term income protection |

| 40 | Term 10 | $27.00 | $18.00 | Remaining mortgage, mid-stage parenting |

| 40 | Term 20 | $44.10 | $32.63 | Covers until kids become financially independent |

| 40 | Term 30 | $85.07 | $62.19 | Longer debts, extended income replacement |

| 50 | Term 10 | $57.05 | $44.60 | Debt payoff, short-term income replacement |

| 50 | Term 20 | $112.83 | $80.11 | Covers spouse until retirement |

| 50 | Term 30 | $218.25 | $155.54 | Late-life dependents, large debt obligations |

Source: LifeInsuranceCanada.com, monthly term life insurance premiums as of October 02, 2025

10. Permanent Life Insurance: When Long-Term Coverage Makes Sense

Permanent life insurance is different from term life insurance in a few ways. One is that the coverage will last your entire life, there is no age at which a permanent life insurance policy expires. The second is that the premium that you pay is level for the entirety of the policy. Term insurance has renewal points at which the premium will increase (following a pre-determined schedule laid out in the original policy), permanent life insurance does not do this. The premium is locked in at the time the policy is issued and won’t change. While permanent insurance can be more expensive than term insurance, it’s a great solution for parents who want lifelong protection and additional benefits, like building cash value over time.

When It Makes Sense for Parents

- Special Needs Dependent – Child or family member who will require lifelong care.

According to the 2021 Census, about 16.3% of children aged 0–14 years were identified as likely to have a disability—indicating potential long-term care needs and reinforcing why lifelong coverage matters. (Source: Statistics Canada, 2021 Census). - Guaranteed Legacy – You want your children to inherit money no matter when you pass away.

One-third of young Canadians say an inheritance is crucial for their goals. The Globe and Mail indicating potential long-term care needs and reinforcing why lifelong coverage matters. (Source: The Globe and Mail) - No Expiry Coverage – You want coverage that doesn’t end after 10, 20 or 30 years.

Unlike term insurance, permanent life coverage never ends as long as premiums are paid. - Estate Tax Planning – You expect taxes or final expenses that your heirs will need to pay.

- Business Succession – You own a business and want to fund a smooth transfer.

Only 30% of family businesses survive to the second generation. (Source: CIBC) - Large Estate Assets – You have property or investments that will trigger taxes when sold.

The Median Canadian home price was $691,643 in June 2025. (CREA Statistics, June 2025), creating potential tax obligations on death. - Final Expense Security – You want funeral and related costs fully covered.

Funeral costs in Canada can be as low as $1,000 or as high as $20,000, with the average around $9,150. (Source: Dignity Memorial) - Family Financial Stability – You want to protect your family’s standard of living for life.

According to the Manulife Bank Financial Health Survey (2024), 51% of Canadians say they could not cover living expenses beyond one month if they lost their primary income. - Permanent Mortgage or Debt – You have long-term loans that won’t be paid off soon.

The average Canadian mortgage balance is $356,831 (Source: Statistics Canada, Q1 2025).

Types of Permanent Life Insurance

- Whole Life: This is the bundled approach to permanent life insurance. You pay a level premium for the entire life of the policy and there is a cash value component that will grow tax-deferred within the policy. There are additional options to purchase what is known as Participating Insurance where the death benefit can grow through the addition of policy dividends, but this is an option, not a requirement.

- Universal Life: This is an unparcelled approach to life insurance. There is an account in the policy where you deposit your premiums. In this account there are investment options you can choose from for where your premium lands. Once a month the policy withdraws the cost of insurance from the account. Any growth in the value of the policy comes from investment growth on your premium deposits. Within CRA guidelines you will not be taxed on the growth as long as the cash remains in the policy.

Benefits for Parents

- Lifelong Security – You know from the time the policy is established what your cost will be for the premium every year making budgeting into the future more easy.

- Estate Planning – Since there is no expiry date you are safe to include the death benefit in your estate plans, even after your family is grown and the original need for the policy is gone.

- Savings Component – Having cash value grow within a whole life policy provides you with an asset that can be utilized later in life.

- Guaranteed Payout – Because there is no expiry date I can guarantee that any in-force whole life policy pays out. How can I do that? Everyone passes away eventually (at least this was true the last time I checked).

- Tax-Deferred Growth – Cash values grow within the policy without triggering taxable income annually, another tax-deferral tool that can help with future income planning.

- Borrowing Option – You can use the policy as collateral or borrow directly from the cash value making it a valuable tool for liquidity

- Wealth Transfer – Death benefits are paid directly to named beneficiaries tax-free so life insurance is one of the most powerful ways to transfer wealth from one generation to the next.

- Stability in Retirement – The cash value in a life insurance policy provides stable returns and can be used in a variety of ways to supplement retirement income.

- Charitable Impact – If you have a favourite cause you can set up a policy s that they are supported when you pass away, creating a legacy.

- Peace of Mind – You know that your life insurance needs are looked after from the day you set up the plan until the day you die without having to consider things like outliving your coverage.

What $500,000 in Permanent Life Insurance Really Costs for Canadian Parents

Average permanent whole life monthly policy premiums for parents at different ages.

| Age | Policy Type | 🚹Male Monthly Cost | 🚺Female Monthly Cost | Coverage Purpose |

| 30 | Whole Life | $257.40 | $224.10 | Lifelong coverage, builds cash value early |

| 35 | Whole Life | $322.20 | $279.90 | Lock in lower rates before mid-life |

| 40 | Whole Life | $391.05 | $338.85 | Secure lifelong protection, estate planning |

| 45 | Whole Life | $522.00 | $436.05 | Protect dependents, growing estate |

| 50 | Whole Life | $631.35 | $540.90 | Cover final expenses, inheritance goals |

| 55 | Whole Life | $830.70 | $663.75 | Late start to lifelong protection |

| 60 | Whole Life | $1062.90 | $898.20 | Preserve estate, leave guaranteed legacy |

Cost Comparison:

Term vs. Permanent Life Insurance for Canadian Parents

Monthly premiums for a healthy male and female, non-smoker with a coverage amount of $250,000.

| Age | 🚹Male Monthly Cost Term 20 year | 🚺Female Monthly Cost Term 20 year | 🚹Male Monthly Cost Permanent Whole Life | 🚺 Female Monthly Cost Permanent Whole Life |

| 30 | $15.98 | $12.96 | $140.85 | $126.00 |

| 35 | $19.13 | $14.40 | $169.65 | $149.40 |

| 40 | $26.55 | $19.58 | $204.75 | $178.20 |

| 45 | $40.95 | $29.70 | $266.40 | $244.10 |

| 50 | $68.63 | $46.80 | $327.60 | $279.45 |

As you can see, permanent life insurance does cost more than term insurance. In many cases you pay lower premiums for term life than a permanent policy for the first 20 years of the policy. But if you envision a future where you need coverage now as a latent to protect your family but you also want to plan your estate and have options for your retirement then a whole life policy that builds cash value is the option to select.

11. Life Insurance for Stay-at-Home Parents

This topic reminds me of a situation with one of my very first life insurance clients. It was a family where the dad worked at a 9-5 job and the mom was a stay-at-home parent. When we were doing our needs analysis the comment was made that maybe the mom didn’t need life insurance because she didn’t have an income to replace. These clients happened to be long time friends of mine and we got into a discussion about what the value of the stay-at-home parent was. She provided childcare, household management, transportation and countless other tasks that would cost tens of thousands of dollars a year to replace. Without coverage, the surviving partner may face significant financial strain, having to pay for services that were once done for free.

Alternatively, the surviving parent could opt to take on a reduced role at work to help carry out these tasks, but this usually has an accompanying reduction in earnings that could create financial hardships. Needless to say, the mom in this situation sat there beaming as I pointed out just how much what she did added to the home every day and the dad saw that there was real value. When the meeting was done there were life insurance policies on both parents, even though only one of them worked outside of the home.

The Real Cost to Replace a Stay-at-Home Parent

Add intro para

| Service/Role | Estimated Annual Cost | Estimated Monthly Cost | Source |

| Childcare (centre-based, 0–5 yrs) | $7,790 | $649 | Statistics Canada, 2022 |

| Childcare (nanny in home) | $26,669 | $2,222 | Statistics Canada, 2022 |

| Meal Preparation / Groceries | $3,600 | $300 | Food Price Report 2025 |

| House Cleaning (weekly service) | $2,592 | $216 | Homestars average, |

| Laundry (2 loads/week at laundromat) | $480 | $40 | Approx. $3–5 per load |

| Driving Kids / Errands | $1,000 | $83 | Estimated annual cost including fuel and errands |

| Kids Activities & Transport | $731 | $61 | LendingTree annual program cost |

| Total Replacement Value | ~$32,862 | ~$2,738 |

Impact on Family Finances

If you are in a situation where a stay-at-home parent is lost the surviving parent can be forced to make difficult decisions if there wasn’t proper insurance in place. Losing a stay-at-home parent can force the surviving spouse to cut work hours, increase expenses, or take on debt, all of which could be avoided by properly assessing life insurance needs and putting the right coverage in place.

- Reduced Work Hours – This can be because you feel the need to be more supportive of your children after their loss or because you need to take on more in the running of your house day-to-day. Either way there is less income for less time at work.

- Higher Childcare Costs – School hours don’t match work hours in most cases so be it pre-school when all day care is needed or during younger years when before and after school care is needed, you will face higher childcare costs if a stay-at-home parent passes away.

- Increased Household Service Costs – Think of all of the daily tasks that a stay-at-home parent looks after without the partner who is at work even thinking about it. Now think about having to pay someone else to do those things. There’s definitely a financial impact from the loss of a stay-at-home parent.

- Extra Transportation Expenses – Again, while one parent is at work, the stay-at-home parent is able to look after things like making sure that everyone gets to where they need to be. One more task that there is a cost associated with if the parent who was doing it isn’t around.

- Loss of Household Organization – Think about what your house looks like after you’ve been home alone for a weekend. Now think about that being the case all of the time. The loss of the stay-at-home parent and the hundreds of little things they do around the house every day is an expensive service to replace.

- Greater Emotional & Mental Strain – There will be emotional and mental strain. The surviving spouse has lost their partner, the kids have list the parent that is the anchor for them. There can be costs associated with creating strategies on how to deal with these stresses.

- Potential Debt Increase – Without proper insurance planning the money to pay for extra help comes from somewhere. Taking on additional debt is one way this may happen.

- Delayed Savings Goals – With increased pressure on the income coming into the family there may not be as much money available to put away to save for things like retirement or education for the kids.

- Work-Life Balance Strain – A stay-at-home parent reduces a lot of pressure on the parent who works outside the home. If that person is no longer around the surviving parent feels more pressure to be available for their family and that can be a big adjustment.

- Risk of Burnout – Trying to be everything to everyone is hard. If you suddenly have to take on the role of both a stay-at-home parent and maintain your work outside the home as well you definitely are risking your own mental health.

Coverage Recommendations

When we are building a needs analysis for determining how much life insurance a parent needs we will look at a variety of things. We will consider items like coverage amounts, term length suggestions, and how to combine with the working partner’s policy to arrive at how much coverage someone needs. Here is a bit more in-depth look at these type of factors:

- Typical Coverage Amounts – Conducting a needs analysis that shows what amount of money would be needed if you died yesterday is essential. Since no one knows when they are going to die you need to plan like it happened yesterday.

- Suggested Term Length – When you look at big needs like a mortgage or replacement income to help raise your kids you can consider lining up a term insurance policy with renewals that match the length of the need. Have young kids? Think of a twenty year term plan to cover any needs until they reach independence. Same with your mortgage. If you have 10 years left of payments you can get a ten year term to cover that.

- Combining Policies – You need to know a few things. The first is what we just discussed, which is how long does the need have to be covered for. The second is if it is a permanent or temporary need. Cover temporary needs with term policies and permanent ones with whole life plans.

- Adjusting for Inflation – Anyone who has lived through the last couple of years leading out of the COVID-19 pandemic understands just how much of an effect inflation can have. Adding a bit of a buffer to your needs to account for the reduced purchasing power of dollars in the future can be a great help.

- Adding Riders – You can add riders to make it so the policy pays more if you die from an accident, cover your kids with some insurance or have the premiums paid if you become disabled.

- Reviewing Regularly – Make sure that the policy you have keeps up with what you need. Review it regularly because we all know that life changes.

Term Life Costs for a Stay-at-Home Parent

Sample Monthly Premiums for Stay-at-Home Parents (Non-Smoker)

| Age | Coverage Amount | Term Length | 🚹Male Monthly Premium | 🚺Female Monthly Premium |

| 25 | $250,000 | Term-10 | $12.15 | $10.35 |

| 25 | $250,000 | Term-20 | $15.98 | $11.93 |

| 30 | $250,000 | Term-10 | $13.94 | $10.57 |

| 30 | $250,000 | Term-20 | $15.98 | $12.60 |

| 35 | $250,000 | Term-10 | $11.25 | $10.80 |

| 35 | $250,000 | Term-20 | $19.13 | $14.40 |

| 40 | $250,000 | Term-10 | $14.85 | $11.70 |

| 40 | $250,000 | Term-20 | $26.55 | $19.58 |

Getting a life insurance policy for a stay-at-home parent isn’t about replacing lost income, it is about making sure that your family has stability going forward. The cost of childcare, home maintenance and daily life responsibilities can quickly overwhelm a surviving partner. A well-structured policy provides peace of mind, ensuring that no matter what happens, the children’s needs and the family’s way of life are safeguarded.

12. What If One Parent Has Health Issues? Adjusting the Strategy

What do you do if one parent has health issues that make getting life insurance more difficult? There are circumstances where a pre-existing health condition, your job or hobbies you have could make getting life insurance more expensive. If it is a lifestyle choice like a dangerous hobby (spelunking for example, because it’s so much fun to say that word) you can control that by changing what you do with your leisure time. If it is your job or health that is making getting coverage more difficult you may need to examine options for ways to adjust your plan so you can still get insurance coverage for your family. One thing that you need to make sure is that one parent having a hard time getting life insurance doesn’t prevent both parents from getting coverage. Make sure that you have coverage in place for the easier to insure parent while you adjust your plans on how to get your family the life insurance coverage that they need.

How to Adapt Your Coverage

- Prioritize the Healthy Parent’s Policy – It may change the needs analysis for your coverage if one parent has difficulty qualifying for life insurance. Since this is often the case because the insurers view someone as a risk too great to take on you may need to consider the fact that there is a chance that the healthy parent could need more coverage because if something happened to them the impact is magnified.

- Guaranteed Issue & Simplified Issue – You can look at guaranteed issue or simplified issue life insurance policies if you have difficulty qualifying for standard policies. These policies often have limits on coverage and will carry a more expensive premium with them but they do establish the life insurance coverage that you need as a parent.

- Layered Policies – You can look at ways to have multiple policies with different term lengths to make coverage more affordable. Shorter term policies tend to have lower premiums so if you have a need that will go away in 10 years and another that will last 20 years you could consider term lengths that match needs to control your costs.

- Critical Illness Insurance – This is a living benefit policy that pays a lump sum if you are diagnosed with a covered illness and survive a set amount of time. Consider this if a stay-at-home parent is in the picture because disability income replacement isn’t an option but if the stay-at-home parent suffers one of the covered conditions it will provide a lump sum of cash to protect your family financially from any changes that become necessary.

- Spousal Riders – You can look at adding coverage for a spouse to your plan as a rider. These tend to provide lower amounts of coverage but there may be less underwriting as well so it could allow you to get some coverage, which is always better than none.

- Disability Insurance – This is often overlooked and historically was provided through workplace benefits. Having a disability insurance plan that will replace your income if you are unable to go to work due to illness or injury is hugely important and can be the difference between your family’s current lifestyle and a major upheaval if you were unable to go to work but did not pass away.

When you are a parent looking for life insurance you have to understand that your health is a major factor in life insurance affordability and eligibility. According to the Insurance Bureau of Canada, health history is one of the top three factors that influence life insurance premiums. Early planning before health issues develop can save thousands over the life of a policy. What this means is that the earlier you apply the better because not only are you younger, which makes premiums more affordable, but young people are less likely to have been diagnosed with a chronic health condition that can make getting insurance more costly. Since life insurance for parents is essential for protecting your family financially you should make sure to apply early and secure your premium rates now, while you are young and healthy.

13. Comparing Quotes – Tools and Tips for Canadian Families

There are many different life insurance companies in Canada and they all have different ways that they look at risks. What this means is that the premiums that you see will vary depending on who the insurer is and how they view the ‘risk’ associated with your life insurance application. This is why it is essential to get multiple quotes on the coverage you are applying for to make sure that you get the best premium applicable to your situation.

Why Quotes Can Vary in Canada

Reasons life insurance quotes differ:

- Age, health and lifestyle

- Type of policy (term, whole life, universal)

- Policy length and amount

- Provincial differences in rules and rates

- Company-specific underwriting policies

Canadian Fact: In 2023, life and health insurers provided coverage for nearly 30 million Canadians, including 23 million with life insurance, illustrating the widespread reliance families place on these products. (Source: Canadian Life & Health Insurance Association, Facts 2024 p. 2)

Best Tools for Comparing Quotes

When shopping for life insurance, using the right comparison tools can save you time and money.

1. Online Quote Calculators – Using an online quote system can instantly get you a number of quotes from different insurers, providing you with valuable information when it comes to making your decision as to what life insurance policy to get as a parent.

2. Independent Brokers Matter – An independent broker is not linked to any particular insurance company and as a result they can show you a wide range of options from across the industry, not just from the single insurance company that they work for. This means more choice for you and potentially better premiums.

3.Comparing the Whole Market – By being able to shop with all of the insurance companies in Canada you are better equipped to make sure that you find the best combination of premium and coverage to match your needs.

I heard an ad a few years ago on an American based podcast that was for an online insurance broker. The tag line went along the lines of ‘the only time you should need to talk to an agent is if you’re dealing with the FBI’. It made me smile because it is kind of clever, but it also highlights the world we live in today. Gone are the days when you needed an insurance agent to come to your house and have them tell you how much coverage would be from the company they worked for. Instead, you now have the option to work with a trusted online independent broker like LifeInsuranceCanada.com where you can get expert guidance and access to the entire Canadian life insurance market. They also have easy to use quote calculators to make LifeInsuranceCanada.com a truly one-stop shop for your life insurance needs as a parent.

Compare Life Insurance Quotes Instantly

14. Common Coverage Mistakes Parents Make (and How to Avoid Them)

People often think that they have more life insurance coverage than they really do. They look at things like a group benefit plan at work that includes some life insurance and maybe the fact that they have some coverage from the bank that is linked to the payment of credit card debt when you die and think that they have plenty of coverage. The reality is that if this is what you are relying on and have an unexpected event where one of the parents in your family dies you could be in for a severe shortfall financially compared to what you need. Here’s the brightside though, common mistakes are avoidable with the right planning. Let’s review a few common mistakes and how you can avoid them to potentially save your family thousands of dollars and a lot of unnecessary stress.

Table: Common Life Insurance Mistakes Parents Make and How to Avoid Them

| Common Mistake | How to Avoid Common Mistakes |

| Relying Only on Employer Coverage | Often this is only a small amount (1 or 2 times what you earn annually) and you need to be actively at work for the coverage to be in force. Don’t link your life insurance plan to your place of employment. |

| Underestimating Future Expenses | You need to plan based on something happening yesterday, not what you think you might need in 5 or 10 years. We have no idea what the future holds so planning based on guesses doesn’t make for a sound base to your family’s financial security. |

| Choosing the Wrong Term Length | Match the term length to the length that you will have your need. Sure, the ten year term plan has the lowest premium right now, but if your need is twenty years long you will pay a lot more after the renewal of a ten year plan than you would have if you had taken the twenty year option from the get-go. Look at the total cost for the entire time you have the need, not just what it costs today. |

| Ignoring One Parent’s Coverage | Thinking that one parent contributes less to the income of the home so they don’t need life insurance is simply wrong. Make sure that you include the value of all of the things that each parent provides to the home, not simply how much income they have. |

Not Reviewing Coverage After Life Changes | When your life changes your insurance needs will change as well. Having a new baby, moving houses or changing jobs can all result in changing the amount of insurance you need. You need to make sure that you review your policies to know that they still cover what you need them to. |

| Forgetting to Name or Update Beneficiaries | This is a big one. If you were married in the past and your former spouse was the beneficiary on your life insurance and you have remarried but not updated the policy to reflect your new spouse as the beneficiary the insurer pays whoever you last told them to write the death benefit cheque to. That is an unpleasant situation. If you have no beneficiary named, the funds pay into your estate and they are now accessible to your creditors. Again, not what you intended for the money. As part of your reviews make sure that your beneficiary designations are up to date. |

Take the time to review your life insurance plans that are in place today to make sure that you aren’t making any of these mistakes. Try using LifeInsuranceCanada.com’s quote tool as well if you see that your life has changed and you need more insurance.

15. Expert Insights: What Canadian Life Insurance Advisors Want Parents to Know

“You have the right to an easy-to-understand explanation of how insurance works and how insurers calculate price based on relevant facts. If your claim is denied, you have the right to be informed why.”

— Insurance Bureau of Canada, Code of Consumer Rights and Responsibilities

“Parents need to know that life insurance is essential for the financial security of their family. The cost is not a barrier to getting coverage and the risk of living without it far outweighs any argument that you could make to not get it”

— Simon Huften, President of LifeInsuranceCanada.com

16. Top 5 FAQs About Life Insurance for Parents in Canada

The best way to figure out how much coverage you need is to use the LifeInsuranceCanada.com needs analysis calculator. If you are looking to just figure out a starting point to begin your fact finding mission aim for 7-10 times your annual income.

Both types of life insurance fit specific needs. Term life has renewals built in so as you get older the amount of the premium will increase. Whole life offers level premiums for the entire life of the policy. For young families we often see large needs that are temporary in nature (think mortgages or kids that grow up and become independent) so term is a great fit and is very affordable. For your permanent needs (funeral costs and estate plans) you need to use whole life coverage.

Yes, two people can be covered by one policy. If the need is the same for both parents, coverage could be purchased on a joint-first-to-die basis. This is a single policy that covers two people and the death benefit pays out when the first covered person dies. When you compare it to separate policies, a joint policy tends to be less expensive overall, in large part because the insurers only have to administer one policy so the fixed costs are less than two policies. When the need is the same for both parents this is a good solution for getting coverage at a lower overall cost than two individual policies. If the needs analysis reveals different amounts for each parent then you may need to explore two individual policies because a joint policy must have the same coverage for both people covered.

Make sure that you work with an independent advisor who can run multiple quotes for you from multiple different insurers. The comparison tools at LifeInsuranceCanada.com are a great way to get information on multiple options all in the same place. This makes sure that you find the best coverage for your unique circumstance.

17. Case Study: Two Canadian Families, Two Very Different Coverage Plans

Family 1: The Young Toronto Family

Profile: A young family in Toronto, WIlliam and Kate are the parents, William is 37 and Kate is 36. They have two kids, George who is 8 and Charlotte who is 6. They live in a home with a large mortgage on it.

Goal: $500,000 term life coverage each for 20 years.

Outcome: Two years after taking out the policy William dies unexpectedly/ This leaves Kate and the kids in a tough spot. They didn’t do a needs analysis and it turns out that their mortgage has more than $500,000 owing on it. They also didn’t account for supplemental income to help with the costs of raising their family. This means that tough choices need to be made about selling the house and how to pay daily living expenses.

Lesson: While it sounds like a lot of money, $500,000 is not nearly enough for parents of a young family with a mortgage. Completing a needs analysis would have revealed this immediately and Willaim and Kate could have applied for the coverage that they needed to make the life of the surviving parent far more financially secure.

Family 2: The Vancouver New Homeowners

Profile: Parents Todd and Jillian live in Vancouver in a home that is mortgage free with a 10 year old son named Louis.

Goal: $750,000 term life coverage each for 20 years.

Outcome: When Jillian unexpectedly passes away Todd receives $750,000, which was the need that was calculated to help offset things like increased child care costs and allow for continued savings towards Louis’s post-secondary education.

Lesson: Taking the time to sit down and figure out what they would need if one of them were to die unexpectedly allows the family to stay in their home and adjust to the loss of a parent without financial strain. This makes it far easier for them to get the support that they need from one another during a difficult emotional time.

18. Downloadable PDF: Life Insurance Needs Calculator Worksheet For Parents

How to use it:

- Download the PDF.

- Fill in the numbers that apply to your family.

- Bring it to an independent broker or use it with our online quote tool to see exactly how much coverage to buy.

Download PDF: Life Insurance Needs Calculator Worksheet For Parents

19. Conclusion: Get the Right Policy and Protect Your Children’s Future

If you are a parent and you don’t have it, the time to get life insurance is right now. As we talked about, your age plays a significant role in how much the insurance costs and there’s no time in your life when it will be cheaper to get insurance than right now because I know for sure that if you wait, you’ll be older when you finally do it. Apply now, when your health is good and you have far less to concern yourself with over your ability to get life insurance. As a parent you owe it to your family to make sure that you have life insurance. Your responsibility to look after your family doesn’t end at the end of your life. You have a responsibility to make sure that your family is cared for until they get to the point in their life that they are financially independent. Having a life insurance policy in place is a way to make sure that this responsibility is looked after. Make sure that you speak to an independent life insurance broker like the team at LifeInsuranceCanada.com to see all of the options that are available to you and make use of the tools they have that will help you determine how much insurance you need. If you need help from an advisor the LifeInsuranceCanada.com team can guide you through the process and get you started with your personalized quotes today. And remember, today is the day you need to look after this.

Get a free quote

200+ Five-Star Reviews on Google