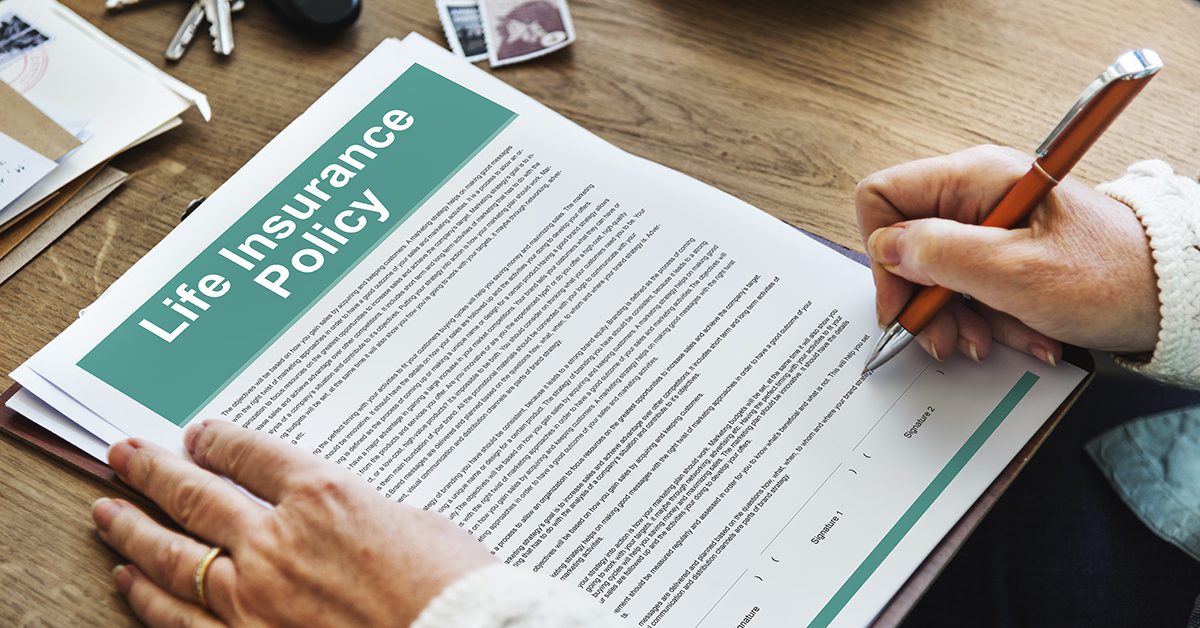

Term life insurance is a valuable part of a financial security plan. It provides you with death benefit coverage that allows you a certain amount of peace of mind that if something unexpected happened to you, your beneficiaries (loved ones) would be taken care of financially. Many term life insurance policies are issued on a renewable basis. This means that at the time the policy is issued, the premiums (the cost of the policy) are laid out for the entirety of the policy.

For example, if you purchase a ten year term life insurance policy it will have fixed premiums for the first 10 years of the policy. At the end of the 10 years, the policy will “renew” which means that you do not have to re-qualify health wise, you just have to pay the increase in the premiums. The cost of the policy increases and stays level for another 10 years. As long as you pay the increased premiums, the policy will stay in force.

What does it mean though if your term life insurance policy is also convertible? This is a clause provided from some life insurance carriers that allows the policy holder to “convert” their term life insurance coverage into a permanent life insurance plan without needing to go through any underwriting. Let’s look at this option a bit more closely.

A conversion option will allow you to convert up to the face amount of your existing term life insurance policy into a permanent life insurance plan with no underwriting required. Regardless of any significant health changes or any lifestyle changes, the life insurance company is contractually obligated to issue you with the permanent life insurance coverage.

Why is this a feature that is good to have? Why would you want to convert a term policy to a permanent policy?

Permanent life insurance fits a different gap in people’s long term financial plans. It also provides different benefits when compared to term life insurance. There will be no more renewal premium increases as rates are fixed for life, there is no expiry date and there may be cash values associated with a permanent plan that are not part of a term life insurance plan.

The main reason to look at converting term life insurance is a change in the need that is being covered. For example, if you own a business you may look at owning term life insurance in the early years of the business to protect yourself against the liabilities that would come due if you were to pass away. As the business becomes more successful over the years, debt levels and other obligations reduce and the need for life insurance changes. Ideally your business becomes successful enough that you are looking at passing it on to different owners. Maybe you have children that will take over and there is now a tax burden on your estate that wasn’t there when you first started. This is an example of why someone would convert their term life insurance. The need that they are covering has changed from something temporary into something permanent.

Another example of why someone would want to convert their term life insurance to permanent life insurance is if their health changed drastically after they purchased a term life insurance policy. If someone purchased a 10 year term policy and are coming near the end of the initial 10 years, if they are unable to purchase a new policy due to changes in their health they may want to consider converting their existing policy to a permanent life insurance plan instead of paying the renewal premiums. This can get complicated so we strongly advise that you speak with one of our informed brokers to determine the right course of action.

At the end of the day, conversion options allow you a certainty that at some point in the future you will be able to get permanent life insurance if you need it. Guaranteed.

The things that you use life insurance to protect against will change over your life. In the early years you are often looking to protect your family as you build your wealth. As time passes you often move towards protecting what you have built up over the course of your life. Having a convertible term life insurance plan means that you know that your coverage can evolve with your needs.